Page 115 - Commercial - Underwriting Mandates & Guidelines Binder

P. 115

Motor

2.1.2.3 Intended for vehicles where the re-sale value is more than the listed retail value.

2.1.2.4 Only available for private type motor cars and light commercial vehicles up to a GVM of 3 500 kg a that have a valid Mead & McGrouther (M&M) code with a retail value attached.

2.1.2.5 Options include retail value plus: 5%, 10%, 15% or 20%. The additional amount (percentage selected) will vary proportionately in accordance to the underlying retail value.

2.1.2.6 At claims stage Hollard will require written proof of value as provided by a motor dealer, accredited professional valuator or registered motor club. Hollard will not pay more than the amount stated in the Schedule or the aforementioned value provided, whichever is the lesser.

2.1.2.7 After market accessories must still be specified on the policy schedule.

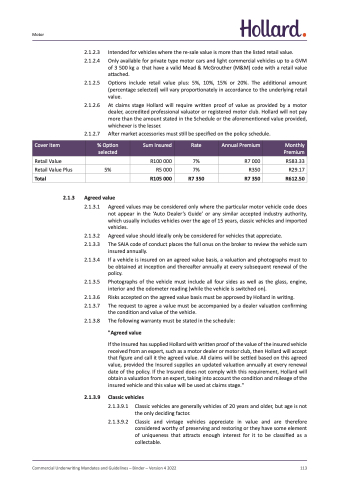

Cover Item

% Option selected

Sum Insured

Rate

Annual Premium

Monthly Premium

Retail Value

Retail Value Plus

Total

5%

Agreed value

R100 000

R5 000

R105 000

7%

7%

R7 350

R7 000

R350

R7 350

R583.33

R29.17

R612.50

2.1.3

2.1.3.1 Agreed values may be considered only where the particular motor vehicle code does not appear in the ‘Auto Dealer’s Guide’ or any similar accepted industry authority, which usually includes vehicles over the age of 15 years, classic vehicles and imported vehicles.

2.1.3.2 Agreed value should ideally only be considered for vehicles that appreciate.

2.1.3.3 The SAIA code of conduct places the full onus on the broker to review the vehicle sum insured annually.

2.1.3.4 If a vehicle is insured on an agreed value basis, a valuation and photographs must to be obtained at inception and thereafter annually at every subsequent renewal of the policy.

2.1.3.5 Photographs of the vehicle must include all four sides as well as the glass, engine, interior and the odometer reading (while the vehicle is switched on).

2.1.3.6 Risks accepted on the agreed value basis must be approved by Hollard in writing.

2.1.3.7 The request to agree a value must be accompanied by a dealer valuation confirming the condition and value of the vehicle.

2.1.3.8 The following warranty must be stated in the schedule:

"Agreed value

If the Insured has supplied Hollard with written proof of the value of the insured vehicle received from an expert, such as a motor dealer or motor club, then Hollard will accept that figure and call it the agreed value. All claims will be settled based on this agreed value, provided the Insured supplies an updated valuation annually at every renewal date of the policy. If the Insured does not comply with this requirement, Hollard will obtain a valuation from an expert, taking into account the condition and mileage of the insured vehicle and this value will be used at claims stage."

2.1.3.9 Classic vehicles

2.1.3.9.1 2.1.3.9.2

Classic vehicles are generally vehicles of 20 years and older, but age is not the only deciding factor.

Classic and vintage vehicles appreciate in value and are therefore considered worthy of preserving and restoring or they have some element of uniqueness that attracts enough interest for it to be classified as a collectable.

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022 113