Page 15 - Personal Underwriting Mandates & Guidelines - Binder - Version 3

P. 15

POLICY CANCELLATION

All policy cancellations (other than a cancellation by the client), must be issued by Hollard and be on a Hollard letterhead. When Hollard terminates a policy, at least 31 days’ notice of the termination must be given and the notice period starts from when the policyholder receives the termination notice.

When does it NOT apply

This requirement does not apply in the following circumstances:

○ if a policy is cancelled on the client's instruction

○ if a policy is terminated due to non-payment of premium. Normal grace periods will however apply, and the policyholder will need to be notified of premium non-payment

○ termination due to a material change in risk to a policy (e.g. fraud), where the policy wording caters for automatic termination or Hollard’s right to terminate the policy

○ legal obligation to terminate a policy. What needs to be done

As the binder broker you must:

○ send the notice to the policyholder within 1 day of receipt from Hollard

○ follow up with the policyholder to confirm receipt of the notice; and

○ send confirmation to Hollard that the policyholder has confirmed receipt or alternatively that the risk insured with Hollard has moved to another insurer

○ all notices of cancellation must be retained for record purposes. What happens if we don’t comply

In addition to any fines or penalties, if Hollard cannot prove that the client was given a full 31 days’ notice period from date of receipt, then we may have to stay on risk for a longer period than intended.

The cancellation of an agency or binder does not necessarily mean that the policies have been automatically cancelled. They remain active until the agency or binder “re-brokers” the policy or Hollard cancels giving 31 days’ notice. Should the agency or binder resign as the FSP of a client, the client must be afforded 31 days to find an alternative binder holder and/or carrier.

Discounts/loadings

It is expected that the binder applies judgment and discretion alongside the scientific rates produced by the black box. Discounting will be measured at a binder level, to ensure that the pricing strength is not eroded and portfolios remain profitable.

Exception reports should be generated regularly by the binder holder to manage the binder’s performance.

General

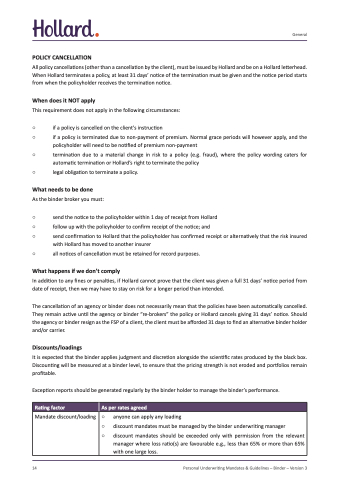

Rating factor

As per rates agreed

Mandate discount/loading

○ anyone can apply any loading

○ discount mandates must be managed by the binder underwriting manager

○ discount mandates should be exceeded only with permission from the relevant manager where loss ratio(s) are favourable e.g., less than 65% or more than 65% with one large loss.

14 Personal Underwriting Mandates & Guidelines – Binder – Version 3