Page 78 - Commercial Underwriting Mandates & Guidelines Binder Addendum

P. 78

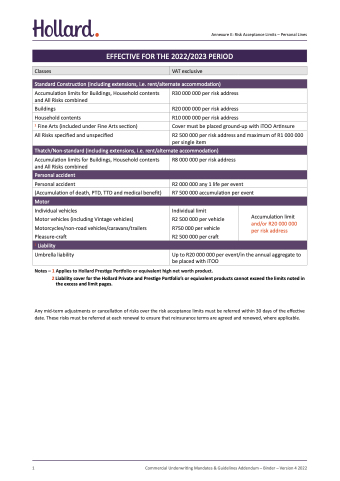

EFFECTIVE FOR THE 2022/2023 PERIOD

Standard Construction (including extensions, i.e. rent/alternate accommodation)

Annexure E: Risk Acceptance Limits – Personal Lines

Classes

VAT exclusive

Accumulation limits for Buildings, Household contents and All Risks combined

Buildings

Household contents

1 Fine Arts (included under Fine Arts section)

All Risks specified and unspecified

R30 000 000 per risk address

R20 000 000 per risk address

R10 000 000 per risk address

Cover must be placed ground-up with iTOO Artinsure

R2 500 000 per risk address and maximum of R1 000 000 per single item

Thatch/Non-standard (including extensions, i.e. rent/alternate accommodation)

Accumulation limits for Buildings, Household contents and All Risks combined

Personal accident

Personal accident

(Accumulation of death, PTD, TTD and medical benefit)

Motor

Individual vehicles

Motor vehicles (including Vintage vehicles) Motorcycles/non-road vehicles/caravans/trailers Pleasure-craft

2 Liability

Umbrella liability

R8 000 000 per risk address

R2 000 000 any 1 life per event

R7 500 000 accumulation per event

Notes – 1 Applies to Hollard Prestige Portfolio or equivalent high net worth product.

2 Liability cover for the Hollard Private and Prestige Portfolio’s or equivalent products cannot exceed the limits noted in

the excess and limit pages.

Any mid-term adjustments or cancellation of risks over the risk acceptance limits must be referred within 30 days of the effective date. These risks must be referred at each renewal to ensure that reinsurance terms are agreed and renewed, where applicable.

Individual limit

R2 500 000 per vehicle R750 000 per vehicle R2 500 000 per craft

Accumulation limit

and/or R20 000 000 per risk address

Up to R20 000 000 per event/in the annual aggregate to be placed with iTOO

1

Commercial Underwriting Mandates & Guidelines Addendum – Binder – Version 4 2022