Page 26 - AreaNewsletters "Mar2023" issue

P. 26

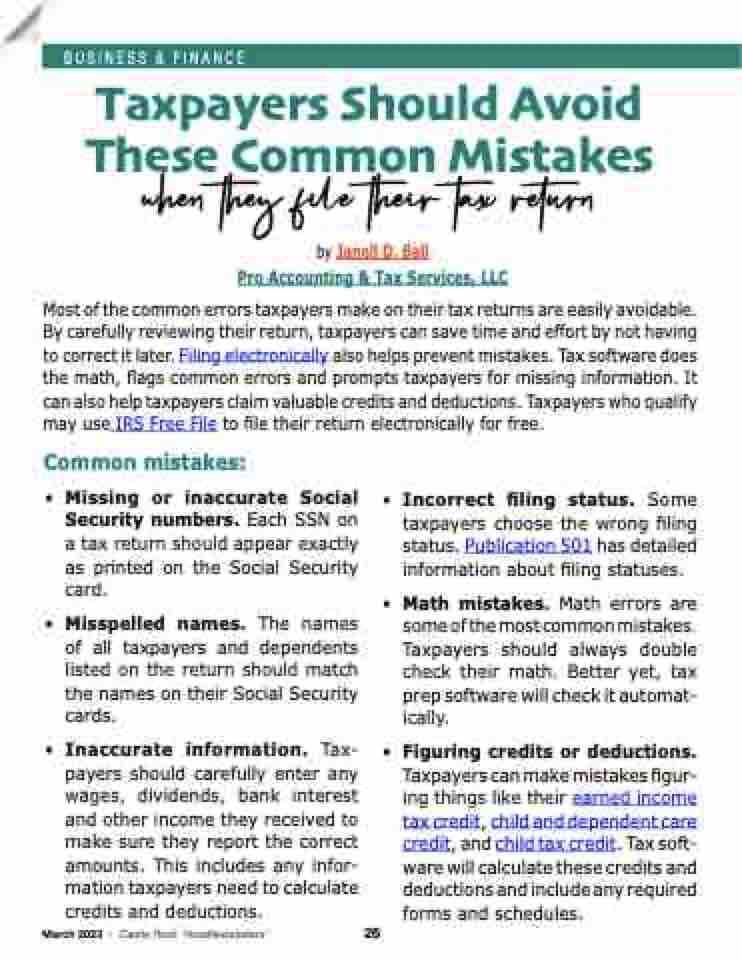

Taxpayers Should Avoid These Common Mistakes

when they file their tax return

by Janell D. Ball

Pro Accounting & Tax Services, LLC

Most of the common errors taxpayers make on their tax returns are easily avoidable. By carefully reviewing their return, taxpayers can save time and effort by not having to correct it later. Filing electronically also helps prevent mistakes. Tax software does the math, flags common errors and prompts taxpayers for missing information. It can also help taxpayers claim valuable credits and deductions. Taxpayers who qualify may use IRS Free File to file their return electronically for free.

Common mistakes:

• Missing or inaccurate Social Security numbers. Each SSN on a tax return should appear exactly as printed on the Social Security card.

• Misspelled names. The names of all taxpayers and dependents listed on the return should match the names on their Social Security cards.

• Inaccurate information. Tax- payers should carefully enter any wages, dividends, bank interest and other income they received to make sure they report the correct amounts. This includes any infor- mation taxpayers need to calculate credits and deductions.

March 2023 • Castle Rock “AreaNewsletters”

• Incorrect filing status. Some taxpayers choose the wrong filing status. Publication 501 has detailed information about filing statuses.

• Math mistakes. Math errors are some of the most common mistakes. Taxpayers should always double check their math. Better yet, tax prep software will check it automat- ically.

• Figuring credits or deductions. Taxpayers can make mistakes figur- ing things like their earned income tax credit, child and dependent care credit, and child tax credit. Tax soft- ware will calculate these credits and deductions and include any required forms and schedules.

26

B US I NE S S & F I NA NCE