Page 17 - Windermere Mercer Island Recruitment

P. 17

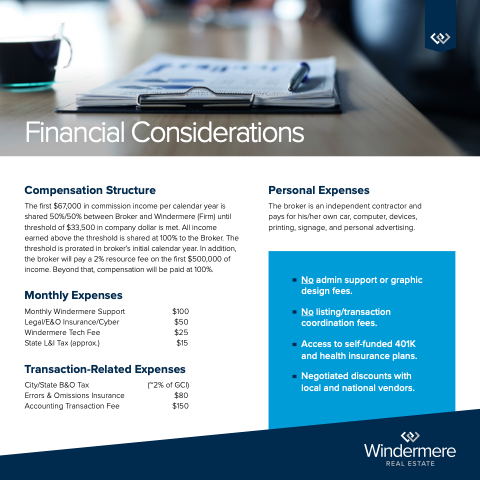

Financial Considerations

Compensation Structure

The first $67,000 in commission income per calendar year is shared 50%/50% between Broker and Windermere (Firm) until threshold of $33,500 in company dollar is met. All income earned above the threshold is shared at 100% to the Broker. The threshold is prorated in broker’s initial calendar year. In addition, the broker will pay a 2% resource fee on the first $500,000 of income. Beyond that, compensation will be paid at 100%.

Monthly Expenses

Monthly Windermere Support $100 Legal/E&O Insurance/Cyber $50 Windermere Tech Fee $25 State L&I Tax (approx.) $15

Transaction-Related Expenses

Personal Expenses

The broker is an independent contractor and pays for his/her own car, computer, devices, printing, signage, and personal advertising.

City/State B&O Tax

Errors & Omissions Insurance Accounting Transaction Fee

(~2% of GCI) $80 $150

No admin support or graphic design fees.

No listing/transaction coordination fees.

Access to self-funded 401K and health insurance plans.

Negotiated discounts with local and national vendors.