Page 27 - Selling Your Home

P. 27

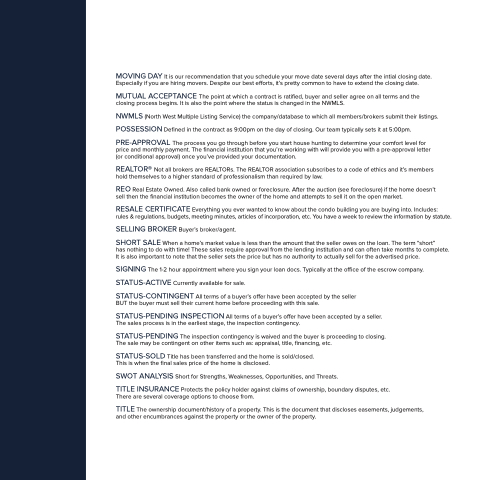

MOVING DAY It is our recommendation that you schedule your move date several days after the intial closing date. Especially if you are hiring movers. Despite our best efforts, it’s pretty common to have to extend the closing date.

MUTUAL ACCEPTANCE The point at which a contract is ratified, buyer and seller agree on all terms and the closing process begins. It is also the point where the status is changed in the NWMLS.

NWMLS (North West Multiple Listing Service) the company/database to which all members/brokers submit their listings. POSSESSION Defined in the contract as 9:00pm on the day of closing. Our team typically sets it at 5:00pm.

PRE-APPROVAL The process you go through before you start house hunting to determine your comfort level for price and monthly payment. The financial institution that you’re working with will provide you with a pre-approval letter (or conditional approval) once you’ve provided your documentation.

REALTOR® Not all brokers are REALTORs. The REALTOR association subscribes to a code of ethics and it’s members hold themselves to a higher standard of professionalism than required by law.

REO Real Estate Owned. Also called bank owned or foreclosure. After the auction (see foreclosure) if the home doesn’t sell then the financial institution becomes the owner of the home and attempts to sell it on the open market.

RESALE CERTIFICATE Everything you ever wanted to know about the condo building you are buying into. Includes: rules & regulations, budgets, meeting minutes, articles of incorporation, etc. You have a week to review the information by statute.

SELLING BROKER Buyer’s broker/agent.

SHORT SALE When a home’s market value is less than the amount that the seller owes on the loan. The term “short”

has nothing to do with time! These sales require approval from the lending institution and can often take months to complete. It is also important to note that the seller sets the price but has no authority to actually sell for the advertised price.

SIGNING The 1-2 hour appointment where you sign your loan docs. Typically at the office of the escrow company. STATUS-ACTIVE Currently available for sale.

STATUS-CONTINGENT All terms of a buyer’s offer have been accepted by the seller BUT the buyer must sell their current home before proceeding with this sale.

STATUS-PENDING INSPECTION All terms of a buyer’s offer have been accepted by a seller. The sales process is in the earliest stage, the inspection contingency.

STATUS-PENDING The inspection contingency is waived and the buyer is proceeding to closing. The sale may be contingent on other items such as: appraisal, title, financing, etc.

STATUS-SOLD Title has been transferred and the home is sold/closed. This is when the final sales price of the home is disclosed.

SWOT ANALYSIS Short for Strengths, Weaknesses, Opportunities, and Threats.

TITLE INSURANCE Protects the policy holder against claims of ownership, boundary disputes, etc.

There are several coverage options to choose from.

TITLE The ownership document/history of a property. This is the document that discloses easements, judgements, and other encumbrances against the property or the owner of the property.