Page 48 - Integrated Annual Report

P. 48

REPORT OF THE REMUNERATION COMMITTEE (CONTINUED)

The fair value of options granted is measured using the Black-Scholes model. Share options granted in the current year were fair valued using a volatility indicator of 85% (2020: 23%) and an annual interest rate of 3.5% (2020: 6.5%). The cost relating to options is recognised by allocating the fair value over the vesting period on a straight-line basis.

The volume weighted average share price during the current year was R35.56 (2020: R89.31).

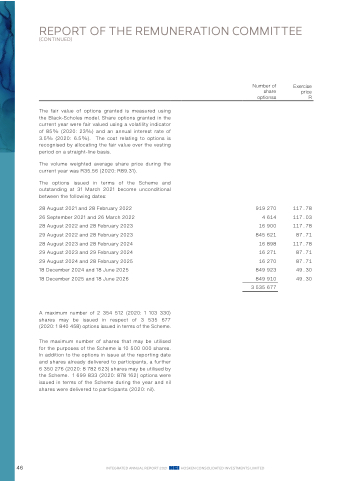

The options issued in terms of the Scheme and outstanding at 31 March 2021 become unconditional between the following dates:

28 August 2021 and 28 February 2022 26 September 2021 and 26 March 2022 28 August 2022 and 28 February 2023 29 August 2022 and 28 February 2023 28 August 2023 and 28 February 2024 29 August 2023 and 29 February 2024 29 August 2024 and 28 February 2025 18 December 2024 and 18 June 2025 18 December 2025 and 18 June 2026

A maximum number of 2 354 512 (2020: 1 103 330) shares may be issued in respect of 3 535 677 (2020: 1 840 458) options issued in terms of the Scheme.

The maximum number of shares that may be utilised for the purposes of the Scheme is 10 500 000 shares. In addition to the options in issue at the reporting date and shares already delivered to participants, a further 6 350 276 (2020: 8 782 623) shares may be utilised by the Scheme. 1 699 833 (2020: 878 162) options were issued in terms of the Scheme during the year and nil shares were delivered to participants (2020: nil).

919 270 4 614 16 900 845 621 16 898 16 271 16 270 849 923 849 910 535 677

117.78 117.03 117.78

87.71 117.78 87.71 87.71 49.30 49.30

Number of share optionss

Exercise price R

3

46

INTEGRATED ANNUAL REPORT 2021

HOSKEN CONSOLIDATED INVESTMENTS LIMITED