Page 105 - Anuario Abrasca 19_20

P. 105

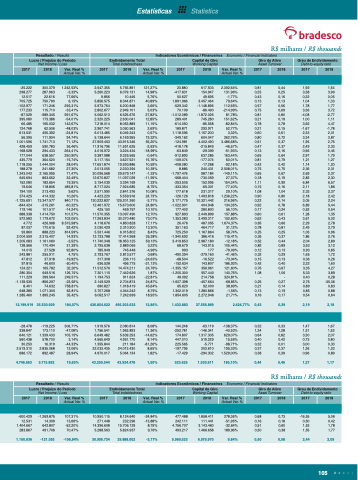

Estatísticas Statistics

R$ milhares / R$ thousands

Resultado / Results

Indicadores Econômicos / Financeiros Economic / Financial Indicators

Lucro / Prejuízo do Período

Net Income / Loss

Endividamento Total

Total indebtedness

Capital de Giro

Working Capital

Giro do Ativo

Asset Turnover

Grau de Endividamento

Debt-to-equity ratio

2017

2018

Var. Real %

Actual Var. %

2017

2018

Var. Real %

Actual Var. %

2017

2018

Var. Real %

Actual Var. %

2017

2018

2017

2018

-25.222 300.379 1.242,53% 2.547.355 5.756.891 121,27% 23.880 617.503 2.392,64% 0,81 0,44 1,59 1,54 298.277 287.963 -3,33% 5.260.223 6.079.131 14,98% -417.631 154.947 131,96% 0,25 0,25 3,38 3,99 12.517 22.616 77,66% 9.856 10.446 5,76% 50.627 49.695 -1,77% 0,43 0,16 0,22 0,05 705.725 750.790 6,15% 5.856.575 8.344.871 40,89% 1.891.966 3.457.464 79,64% 0,13 0,13 1,04 1,33 -102.977 171.246 256,31% 5.973.754 6.200.848 3,66% -529.342 -1.148.896 112,65% 0,57 0,56 1,78 1,77 177.233 115.710 -33,41% 2.802.677 2.949.101 5,03% 70.109 -86.490 -214,99% 0,75 0,69 3,36 3,72 -87.529 -989.345 991,67% 5.062.513 6.525.676 27,82% -1.012.089 -1.872.026 81,78% 0,81 0,80 -4,08 -2,77 395.080 173.386 -54,01% 2.320.225 2.630.041 12,85% 289.401 745.280 151,62% 0,21 0,19 1,00 1,11 66.485 165.032 142,67% 7.218.014 8.053.889 11,15% -614.050 -85.558 -82,84% 0,78 0,78 3,92 4,47 124.768 62.506 -48,03% 2.967.741 3.050.563 2,69% 189.871 293.971 52,77% 0,21 0,15 -1,67 -1,78 613.531 455.392 -24,81% 6.013.485 6.049.243 0,57% 1.118.596 1.157.200 3,32% 0,60 0,61 2,33 2,01 56.395 111.904 94,74% 5.138.644 6.169.955 19,32% -349.162 604.047 262,76% 0,80 0,72 3,34 3,87 1.001.596 1.741.713 71,12% 27.909.453 43.915.346 55,20% -124.981 4.402.490 3.486,68% 0,51 0,37 1,95 2,76 428.459 590.783 36,46% 11.916.796 11.591.625 -2,63% -418.178 -215.849 -46,57% 0,47 0,37 2,49 2,33 -168.528 294.433 264,41% 4.016.972 3.224.434 -18,99% -63.849 -29.399 -51,93% 0,13 0,16 0,56 0,45 177.044 638.557 250,90% 9.387.988 9.325.565 -0,64% -912.893 637.285 163,44% 0,65 0,64 2,97 1,79 435.779 364.520 -15,74% 3.117.154 3.627.521 15,76% -109.074 -177.074 60,01% 0,81 0,79 1,21 1,27 1.118.255 1.444.004 28,04% 17.651.874 19.593.886 10,59% -408.080 -17.268 -92,18% 0,42 0,42 1,14 1,20 188.278 241.682 27,30% 2.013.055 2.230.394 10,39% 8.886 240.431 2.508,01% 0,75 0,75 2,36 2,31 1.243.042 2.165.995 71,47% 30.096.568 29.679.147 -1,33% -1.797.476 987.184 -149,11% 0,65 0,67 2,69 2,37 645.694 863.652 32,49% 12.670.827 11.097.029 -11,95% -568.404 -730.059 27,37% 0,18 0,19 2,82 2,30 152.080 182.654 19,35% 3.154.039 3.394.169 7,33% -253.505 152.995 154,34% 1,11 0,99 6,84 6,57 19.646 118.806 485,81% 8.717.024 7.924.685 -8,75% -333.354 -65.301 -77,40% 0,15 0,16 2,11 1,86 194.100 213.493 9,62% 2.571.990 2.841.376 10,08% 177.618 231.317 29,10% 1,08 1,04 2,33 2,37 374.425 414.332 10,26% 4.423.220 5.559.916 24,73% -126.126 1.493.818 1.236,22% 0,90 0,80 2,18 2,42 -1.725.691 13.347.577 840,71% 130.222.827 125.201.260 -3,71% 3.171.775 10.321.442 216,96% 0,22 0,14 3,05 2,24 -844.424 -315.261 -60,32% 12.461.972 15.673.600 24,80% -1.022.901 404.948 134,35% 0,92 0,78 6,89 5,44 119.146 101.517 -14,24% 425.150 469.757 10,10% 177.402 280.800 56,10% 0,17 0,24 0,52 0,54 688.338 1.414.750 101,57% 11.570.355 13.097.490 12,70% 927.893 2.449.899 157,88% 0,60 0,61 1,28 1,35 572.582 1.179.672 102,05% 17.263.834 30.370.480 73,07% 1.353.283 3.499.317 152,63% 0,62 0,43 3,61 5,02 4.772 426.968 8.515,58% 4.118.676 4.850.828 17,11% 26.476 487.055 1.674,37% 0,65 0,66 2,29 2,78 87.037 170.615 92,42% 2.030.429 2.310.900 13,30% 351.163 464.717 31,12% 0,78 0,81 2,49 2,79 93.860 888.223 814,59% 5.531.446 6.015.802 8,43% 725.250 1.167.864 58,74% 0,25 0,25 1,03 0,96 2.004.559 2.315.407 14,93% 12.733.788 17.414.968 35,38% -1.940.692 386.416 115,41% 0,36 0,37 1,86 2,76 1.205.083 1.161.060 -3,52% 11.740.348 18.953.125 59,13% 3.419.853 2.987.180 -12,18% 0,52 0,44 2,04 2,89 128.566 170.494 31,39% 2.795.638 2.889.066 3,22% 68.679 143.915 105,44% 0,82 0,89 3,53 3,12 14.015 27.528 92,80% 785.949 745.448 -4,96% 993 177 -79,09% 0,12 0,13 0,93 0,85 243.881 255.911 4,75% 2.793.767 2.813.577 0,68% -490.394 -279.160 -41,46% 0,32 0,29 1,65 1,72 47.812 37.918 -19,92% 317.308 236.113 -24,63% -68.504 -16.522 -73,04% 0,15 0,13 0,36 0,26 97.815 46.600 -50,40% 636.528 496.775 -21,13% -152.634 143.807 186,93% 0,42 0,40 2,22 1,60 124.221 165.782 32,20% 11.512.576 14.474.211 24,76% -1.355.157 356.961 121,60% 0,76 0,67 3,35 4,27 280.354 649.516 126,74% 7.301.115 7.442.626 1,87% -1.205.300 557.440 140,76% 1,08 1,06 5,33 3,89 111.229 399.564 249,51% 1.194.753 911.624 -22,81% 49.092 214.758 324,81% - - 0,40 0,28 -1.139.535 -856.297 -23,92% 2.149.529 2.704.874 24,87% -1.607.398 -457.664 -68,85% 0,25 0,27 2,76 -35,36 8.401 74.632 758,81% 690.827 1.018.419 45,64% 65.620 92.000 38,69% 0,21 0,14 0,89 0,83 648.285 1.071.305 62,81% 3.707.268 4.044.242 8,75% 1.302.019 1.280.866 -1,56% 0,13 0,19 0,85 0,88 1.385.460 1.895.245 35,42% 6.052.517 7.242.699 18,93% 1.854.605 2.272.946 21,71% 0,16 0,17 0,54 0,64

12.199.919 35.530.929 184,07% 436.854.622 495.203.632 12,86% 1.433.883 37.556.869 2.424,77% 0,43 0,39 2,19 2,18

-28.478 -119.225 306,71% 1.919.576 2.080.814 8,08% 144.248 -63.119 -138,37% 0,32 0,33 1,47 1,67 338.847 173.110 -47,08% 1.756.541 1.963.893 11,36% -252.781 -146.341 -40,53% 1,24 1,28 1,31 1,52 640.121 1.339.433 105,15% 6.649.482 5.639.253 -14,62% 174.807 1.317.305 629,07% 0,64 0,82 3,30 2,07 560.438 578.700 3,14% 4.565.649 4.951.770 8,14% 447.010 519.229 15,55% 0,40 0,42 0,73 0,80

30.253 16.319 -44,33% 1.355.844 211.184 -81,26% 225.565 -5.771 -98,71% 0,32 0,01 3,00 0,33 2.519.310 2.835.068 12,06% 22.033.435 24.013.430 8,65% -197.795 203.610 195,33% 0,37 0,37 1,26 1,23 686.172 892.487 28,94% 4.970.017 5.064.134 1,82% -17.429 -294.302 1.529,00% 0,38 0,39 0,96 0,89

4.746.663 5.715.892 19,65% 43.250.544 43.924.478 1,50% 523.625 1.530.611 185,10% 0,44 0,46 1,27 1,17

R$ milhares / R$ thousands

Resultado / Results

Indicadores Econômicos / Financeiros Economic / Financial Indicators

Lucro / Prejuízo do Período

Net Income / Loss

Endividamento Total

Total indebtedness

Capital de Giro

Working Capital

Giro do Ativo

Asset Turnover

Grau de Endividamento

Debt-to-equity ratio

2017

2018

Var. Real %

Actual Var. %

2017

2018

Var. Real %

Actual Var. %

2017

2018

Var. Real %

Actual Var. %

2017

2018

2017

2018

-600.429 -1.269.875 107,31% 10.950.115 8.124.640 -24,84% 477.488 1.858.411 278,36% 0,68 0,73 -16,55 5,06 12.531 14.309 13,66% 271.448 232.296 -13,88% 242.111 111.441 -51,95% 0,16 0,18 0,50 0,42 1.404.667 642.807 -52,20% 14.396.608 15.706.129 8,75% 4.756.707 3.143.460 -32,64% 0,51 0,60 1,53 1,78 283.867 491.706 70,47% 5.288.563 5.824.937 9,76% 493.217 1.466.658 189,96% 0,30 0,38 1,55 1,77

1.100.636 -121.053 -106,84% 30.906.734 29.888.002 -3,17% 5.969.523 6.579.970 9,84% 0,50 0,58 2,44 2,09

105