Page 120 - Chronicle Vol 17

P. 120

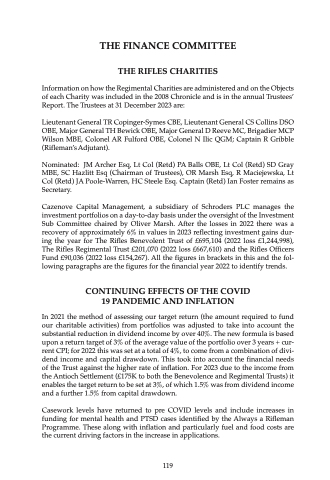

THE FINANCE COMMITTEE THE RIFLES CHARITIES

Information on how the Regimental Charities are administered and on the Objects of each Charity was included in the 2008 Chronicle and is in the annual Trustees’ Report. The Trustees at 31 December 2023 are:

Lieutenant General TR Copinger-Symes CBE, Lieutenant General CS Collins DSO OBE, Major General TH Bewick OBE, Major General D Reeve MC, Brigadier MCP Wilson MBE, Colonel AR Fulford OBE, Colonel N Ilic QGM; Captain R Gribble (Rifleman’sAdjutant).

Nominated: JM Archer Esq, Lt Col (Retd) PA Balls OBE, Lt Col (Retd) SD Gray MBE, SC Hazlitt Esq (Chairman of Trustees), OR Marsh Esq, R Maciejewska, Lt Col (Retd) JA Poole-Warren, HC Steele Esq. Captain (Retd) Ian Foster remains as Secretary.

Cazenove Capital Management, a subsidiary of Schroders PLC manages the investment portfolios on a day-to-day basis under the oversight of the Investment Sub Committee chaired by Oliver Marsh. After the losses in 2022 there was a recovery of approximately 6% in values in 2023 reflecting investment gains dur- ing the year for The Rifles Benevolent Trust of £695,104 (2022 loss £1,244,998), The Rifles Regimental Trust £201,070 (2022 loss £667,610) and the Rifles Officers Fund £90,036 (2022 loss £154,267). All the figures in brackets in this and the fol- lowing paragraphs are the figures for the financial year 2022 to identify trends.

CONTINUING EFFECTS OF THE COVID 19 PANDEMIC AND INFLATION

In 2021 the method of assessing our target return (the amount required to fund our charitable activities) from portfolios was adjusted to take into account the substantial reduction in dividend income by over 40%. The new formula is based upon a return target of 3% of the average value of the portfolio over 3 years + cur- rent CPI; for 2022 this was set at a total of 4%, to come from a combination of divi- dend income and capital drawdown. This took into account the financial needs of the Trust against the higher rate of inflation. For 2023 due to the income from the Antioch Settlement (£175K to both the Benevolence and Regimental Trusts) it enables the target return to be set at 3%, of which 1.5% was from dividend income and a further 1.5% from capital drawdown.

Casework levels have returned to pre COVID levels and include increases in funding for mental health and PTSD cases identified by the Always a Rifleman Programme. These along with inflation and particularly fuel and food costs are the current driving factors in the increase in applications.

119