Page 44 - ABC Company 2018 Open Enrollment Guide

P. 44

44

2018 Open Enrollment | powered by Choice.

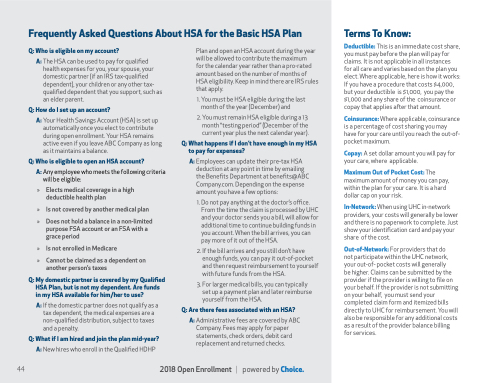

Frequently Asked Questions About HSA for the Basic HSA Plan

Q: Who is eligible on my account?

A: The HSA can be used to pay for qualified health expenses for you, your spouse, your domestic partner (if an IRS tax-qualified dependent), your children or any other tax- qualified dependent that you support, such as an elder parent.

Q: How do I set up an account?

A: Your Health Savings Account (HSA) is set up automatically once you elect to contribute during open enrollment. Your HSA remains active even if you leave ABC Company as long as it maintains a balance.

Q: Who is eligible to open an HSA account?

A: Any employee who meets the following criteria

will be eligible:

» Elects medical coverage in a high deductible health plan

» Is not covered by another medical plan

» Does not hold a balance in a non-limited purpose FSA account or an FSA with a grace period

» Is not enrolled in Medicare » Cannot be claimed as a dependent on

another person’s taxes

Q: My domestic partner is covered by my Qualified HSA Plan, but is not my dependent. Are funds in my HSA available for him/her to use?

A: If the domestic partner does not qualify as a tax dependent, the medical expenses are a non-qualified distribution, subject to taxes and a penalty.

Q: What if I am hired and join the plan mid-year? A: New hires who enroll in the Qualified HDHP

Plan and open an HSA account during the year will be allowed to contribute the maximum

for the calendar year rather than a pro-rated amount based on the number of months of HSA eligibility. Keep in mind there are IRS rules that apply.

1. You must be HSA eligible during the last month of the year (December) and

2. You must remain HSA eligible during a 13 month “testing period” (December of the current year plus the next calendar year).

Q: What happens if I don’t have enough in my HSA to pay for expenses?

A: Employees can update their pre-tax HSA deduction at any point in time by emailing the Benefits Department at benefits@ABC Company.com. Depending on the expense amount you have a few options:

1. Do not pay anything at the doctor’s office. From the time the claim is processed by UHC and your doctor sends you a bill, will allow for additional time to continue building funds in you account. When the bill arrives, you can pay more of it out of the HSA.

2. If the bill arrives and you still don’t have enough funds, you can pay it out-of-pocket and then request reimbursement to yourself with future funds from the HSA.

3. For larger medical bills, you can typically set up a payment plan and later reimburse yourself from the HSA.

Q: Are there fees associated with an HSA?

A: Administrative fees are covered by ABC Company. Fees may apply for paper statements, check orders, debit card replacement and returned checks.

Terms To Know:

Deductible: This is an immediate cost share, you must pay before the plan will pay for claims. It is not applicable in all instances

for all care and varies based on the plan you elect. Where applicable, here is how it works: If you have a procedure that costs $4,000, but your deductible is $1,000, you pay the $1,000 and any share of the coinsurance or copay that applies after that amount.

Coinsurance: Where applicable, coinsurance is a percentage of cost sharing you may have for your care until you reach the out-of- pocket maximum.

Copay: A set dollar amount you will pay for your care, where applicable.

Maximum Out of Pocket Cost: The maximum amount of money you can pay, within the plan for your care. It is a hard dollar cap on your risk.

In-Network: When using UHC in-network providers, your costs will generally be lower and there is no paperwork to complete. Just show your identification card and pay your share of the cost.

Out-of-Network: For providers that do

not participate within the UHC network, your out-of- pocket costs will generally

be higher. Claims can be submitted by the provider if the provider is willing to file on your behalf. If the provider is not submitting on your behalf, you must send your completed claim form and itemized bills directly to UHC for reimbursement. You will also be responsible for any additional costs as a result of the provider balance billing for services.