Page 20 - Skechers 2022 Benefits Guide

P. 20

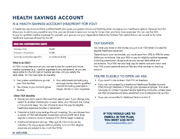

HEALTH SAVINGS ACCOUNT

IS A HEALTH SAVINGS ACCOUNT (HSA) RIGHT FOR YOU?

A Health Savings Account (HSA) qualified health plan gives you greater choice and flexibility when managing your healthcare options. Because the HSA allows you to reimburse yourself at any time, you can choose to save your money for times when you have more expenses. You can use the HSA

to pay for qualified medical expenses for yourself, your spouse and your dependents before the Anthem Plan deductible is met, as well as for other healthcare expenses allowed by the IRS.

2022 HSA CONTRIBUTION LIMITS

Employee Only:

Employee + Dependent: Catch-Up Contributions (age 55+):

What is an HSA?

$3,650

$7,300

An additional $1,000

TAX SAVINGS

You never pay taxes on the money you put in an HSA when it is used for eligible healthcare expenses.

Depending on your tax bracket, you could save from 25% to 40% for every dollar you contribute. Use your HSA to pay for eligible medical expenses (including prescription drugs) such as your annual deductible and coinsurance. Your HSA can also help pay for dental care and vision care. Your HSA is your personal account like any other savings or checking account.

YOU’RE ELIGIBLE TO OPEN AN HSA

• If you enroll in the Anthem HSA PPO at Skechers.

• If you are not covered by a traditional Healthcare Flexible Account (FSA) through Skechers or through your spouse’s employer. This does not apply to Limited Purpose Flexible Spending Accounts —these plans are HSA compatible and allow enrollment and contribution into an HSA.

• If you are not enrolled in Medicare Parts A and/or B.

An HSA is a tax-free account you can use to pay for current and future medical expenses (e.g., medical expenses during retirement), as you are responsible for the full cost of medical services until you satisfy the deductible. An HSA has triple tax benefits:

• Your pretax contributions go into your HSA tax-free

• The money in your account grows tax-free

Other HSA Benefits

• Your withdrawals (including any earnings) are tax free for qualified medical (including prescription drugs), dental or vision expenses

• Money you don’t spend rolls over from year to year. If you change jobs, switch to another medical plan or even retire, your HSA and the money in it is yours to keep. You can choose to save it to pay for eligible healthcare expenses tax-free in retirement.

• Potential to build more savings through investing. You can choose from a variety of HSA self-directed investment options (UMB Bank does require a minimum account balance of $1,000 to begin investing).

• Additional retirement savings. After age 65, HSA funds can be withdrawn for any purpose without penalty, but non-HSA eligible expenses are subject to tax much like 401(k).

IF YOU WOULD LIKE TO ENROLL IN THE PLAN, YOU MUST LOG IN TO skechersbenefits.com

20 SKECHERS