Page 16 - KIPP NYC 2022 Benfits Summary

P. 16

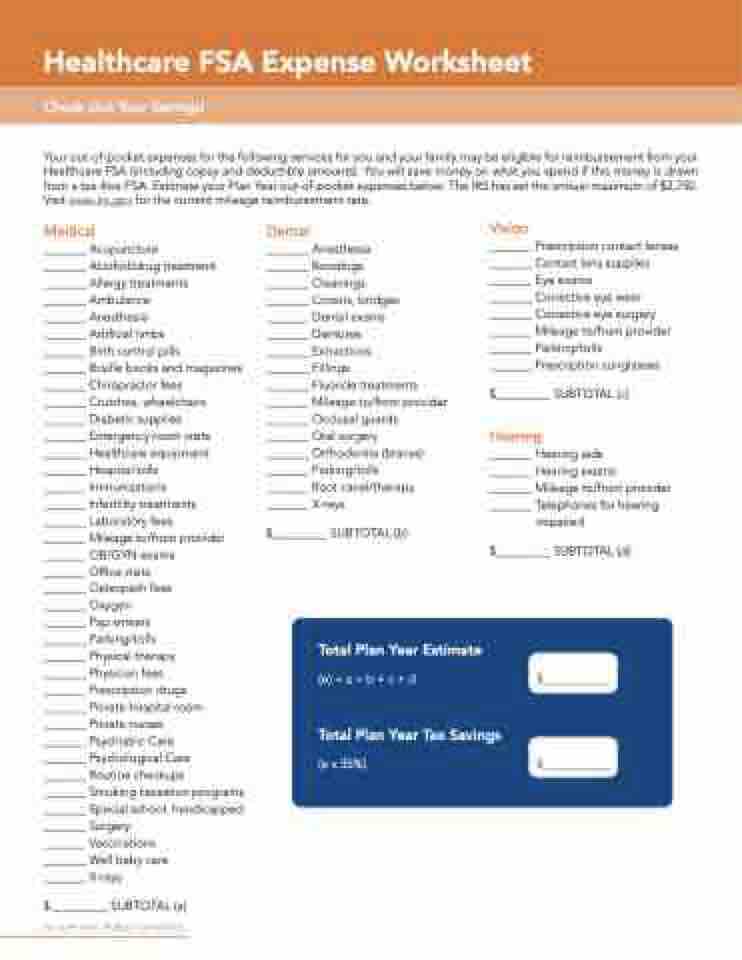

Healthcare FSA Expense Worksheet

Check Out Your Savings!

Your out-of-pocket expenses for the following services for you and your family may be eligible for reimbursement from your Healthcare FSA (including copay and deductible amounts). You will save money on what you spend if this money is drawn from a tax-free FSA. Estimate your Plan Year out-of-pocket expenses below. The IRS has set the annual maximum of $2,750. Visit www.irs.gov for the current mileage reimbursement rate.

Medical

_______ Acupuncture

_______ Alcohol/drug treatment _______ Allergy treatments

_______ Ambulance

_______ Anesthesia

_______ Artificial limbs

_______ Birth control pills

_______ Braille books and magazines _______ Chiropractor fees

_______ Crutches, wheelchairs _______ Diabetic supplies

_______ Emergency room visits _______ Healthcare equipment _______ Hospital bills

_______ Immunizations

_______ Infertility treatments

_______ Laboratory fees

_______ Mileage to/from provider _______ OB/GYN exams

_______ Office visits

_______ Osteopath fees

_______ Oxygen

_______ Pap smears

_______ Parking/tolls

_______ Physical therapy

_______ Physician fees

_______ Prescription drugs

_______ Private hospital room _______ Private nurses

_______ Psychiatric Care

_______ Psychological Care

_______ Routine checkups

_______ Smoking cessation programs _______ Special school, handicapped _______ Surgery

_______ Vaccinations

_______ Well baby care

_______ X-rays

$ _________ SUBTOTAL (a)

16 KIPP NYC PUBLIC SCHOOLS

Dental

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

Anesthesia Bondings Cleanings Crowns, bridges Dental exams Dentures Extractions Fillings

Fluoride treatments Mileage to/from provider Occlusal guards

Oral surgery Orthodontia (braces) Parking/tolls

Root canal/therapy X-rays

Vision

_______ Prescription contact lenses _______ Contact lens supplies _______ Eye exams

_______ Corrective eye wear _______ Corrective eye surgery _______ Mileage to/from provider _______ Parking/tolls

_______ Prescription sunglasses $_________ SUBTOTAL (c)

Hearing

_______ Hearing aids

_______ Hearing exams

_______ Mileage to/from provider _______ Telephones for hearing

impaired $_________ SUBTOTAL (d)

$___________

$___________

$_________ SUBTOTAL (b)

Total Plan Year Estimate

(e) = a + b + c + d

Total Plan Year Tax Savings

(e x 35%)