Page 16 - CAFC Ltd 2022-23

P. 16

THE CREWE ALEXANDRA FOOTBALL CLUB COMPANY LIMITED NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR ENDED 30 JUNE 2023

2 Judgements and key sources of estimation uncertainty

In the application of the company’s accounting policies, the directors are required to make judgements, estimates and assumptions about the carrying amount of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised where the revision affects only that period, or in the period of the revision and future periods where the revision affects both current and future periods.

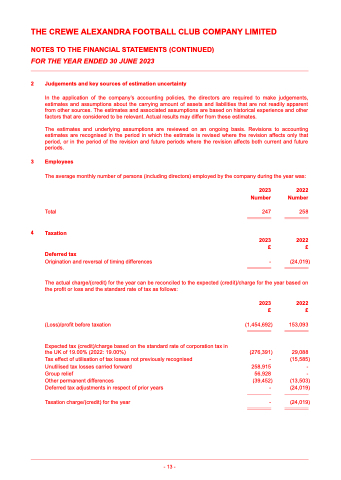

3 Employees

The average monthly number of persons (including directors) employed by the company during the year was:

Total

4 Taxation Deferred tax

Origination and reversal of timing differences

2023 2022 Number Number

247 258

2023 2022 ££

- (24,019)

The actual charge/(credit) for the year can be reconciled to the expected (credit)/charge for the year based on the profit or loss and the standard rate of tax as follows:

(Loss)/profit before taxation

Expected tax (credit)/charge based on the standard rate of corporation tax in the UK of 19.00% (2022: 19.00%)

Tax effect of utilisation of tax losses not previously recognised

Unutilised tax losses carried forward

Group relief

Other permanent differences

Deferred tax adjustments in respect of prior years

Taxation charge/(credit) for the year

(1,454,692)

(276,391) -

258,915 56,928

(39,452) -

-

153,093

29,088 (15,585)

-

- (13,503) (24,019)

(24,019)

2023 2022 ££

- 13 -