Page 1 - AAG060_Items Needed Checklist

P. 1

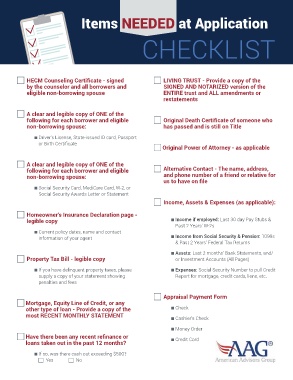

Items NEEDED at Application

c HECM Counseling Certificate - signed c LIVING TRUST - Provide a copy of the

by the counselor and all borrowers and SIGNED AND NOTARIZED version of the

eligible non-borrowing spouse ENTIRE trust and ALL amendments or

restatements

c A clear and legible copy of ONE of the

following for each borrower and eligible c Original Death Certificate of someone who

non-borrowing spouse: has passed and is still on Title

n Driver’s License, State-issued ID card, Passport

or Birth Certificate

c Original Power of Attorney - as applicable

c A clear and legible copy of ONE of the

following for each borrower and eligible c Alternative Contact - The name, address,

non-borrowing spouse: and phone number of a friend or relative for

us to have on file

n Social Security Card, MediCare Card, W-2, or

Social Security Awards Letter or Statement

c Income, Assets & Expenses (as applicable):

c Homeowner’s Insurance Declaration page -

legible copy n Income if employed: Last 30 day Pay Stubs &

Past 2 Years’ W-2s

n Current policy dates, name and contact

information of your agent n Income from Social Security & Pension: 1099s

& Past 2 Years’ Federal Tax Returns

n Assets: Last 2 months’ Bank Statements, and/

c Property Tax Bill - legible copy or Investment Accounts (All Pages)

n If you have delinquent property taxes, please n Expenses: Social Security Number to pull Credit

supply a copy of your statement showing Report for mortgage, credit cards, liens, etc.

penalties and fees

c Appraisal Payment Form

c Mortgage, Equity Line of Credit, or any

other type of loan - Provide a copy of the n Check

most RECENT MONTHLY STATEMENT

n Cashier’s Check

n Money Order

c Have there been any recent refinance or

loans taken out in the past 12 months? n Credit Card

n If so, was there cash out exceeding $500?

c Yes c No