Page 1 - AAG041_Your Guide Flyer

P. 1

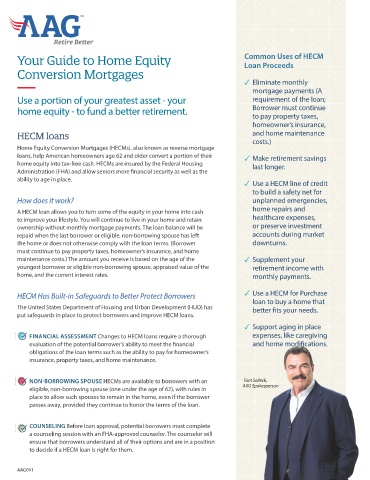

Your Guide to Home Equity Common Uses of HECM

Loan Proceeds

Conversion Mortgages

3 Eliminate monthly

mortgage payments (A

Use a portion of your greatest asset - your requirement of the loan;

home equity - to fund a better retirement. Borrower must continue

to pay property taxes,

homeowner’s insurance,

HECM loans and home maintenance

costs.)

Home Equity Conversion Mortgages (HECMs), also known as reverse mortgage

loans, help American homeowners age 62 and older convert a portion of their 3 Make retirement savings

home equity into tax-free cash. HECMs are insured by the Federal Housing last longer.

Administration (FHA) and allow seniors more financial security as well as the

ability to age in place.

3 Use a HECM line of credit

to build a safety net for

How does it work? unplanned emergencies,

A HECM loan allows you to turn some of the equity in your home into cash home repairs and

to improve your lifestyle. You will continue to live in your home and retain healthcare expenses,

ownership without monthly mortgage payments. The loan balance will be or preserve investment

repaid when the last borrower or eligible, non-borrowing spouse has left accounts during market

the home or does not otherwise comply with the loan terms. (Borrower downturns.

must continue to pay property taxes, homeowner’s insurance, and home

maintenance costs.) The amount you receive is based on the age of the 3 Supplement your

youngest borrower or eligible non-borrowing spouse, appraised value of the retirement income with

home, and the current interest rates. monthly payments.

HECM Has Built-in Safeguards to Better Protect Borrowers 3 Use a HECM for Purchase

loan to buy a home that

The United States Department of Housing and Urban Development (HUD) has better fits your needs.

put safeguards in place to protect borrowers and improve HECM loans.

3 Support aging in place

FINANCIAL ASSESSMENT Changes to HECM loans require a thorough expenses, like caregiving

evaluation of the potential borrower’s ability to meet the financial and home modifications.

obligations of the loan terms such as the ability to pay for homeowner’s

insurance, property taxes, and home maintenance.

NON-BORROWING SPOUSE HECMs are available to borrowers with an Tom Selleck,

eligible, non-borrowing spouse (one under the age of 62), with rules in AAG Spokesperson

place to allow such spouses to remain in the home, even if the borrower

passes away, provided they continue to honor the terms of the loan.

COUNSELING Before loan approval, potential borrowers must complete

a counseling session with an FHA-approved counselor. The counselor will

ensure that borrowers understand all of their options and are in a position

to decide if a HECM loan is right for them.

AAG041