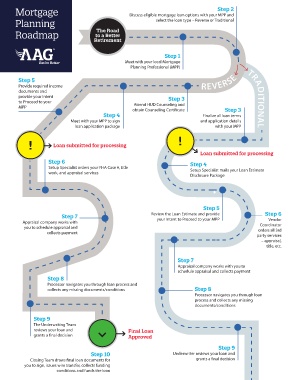

Page 1 - Hybrid Roadmap_B2C

P. 1

Step 2

Mortgage Discuss eligible mortgage loan options with your MPP and

Planning select the loan type – Reverse or Traditional

The Road

Roadmap to a Better

Retirement

Step 1

Meet with your local Mortgage

Planning Professional (MPP)

Step 5 REVERSE

Provide required income

documents and

provide your Intent Step 3

to Proceed to your Attend HUD Counseling and TRADITIONAL

MPP

obtain Counseling Certificate Step 3

Step 4 Finalize all loan terms

Meet with your MPP to sign and application details

loan application package with your MPP

! Loan submitted for processing !

Loan submitted for processing

Step 6 Step 4

Setup Specialist orders your FHA Case #, title

work, and appraisal services Setup Specialist mails your Loan Estimate

Disclosure Package

Step 5

Step 7 Review the Loan Estimate and provide Step 6

your Intent to Proceed to your MPP

Appraisal company works with Vendor

you to schedule appraisal and Coordinator

collects payment orders all 3rd

party services

– appraisal,

title, etc.

Step 7

Appraisal company works with you to

schedule appraisal and collects payment

Step 8

Processor navigates you through loan process and

collects any missing documents/conditions Step 8

Processor navigates you through loan

process and collects any missing

documents/conditions

Step 9

The Underwriting Team

reviews your loan and Final Loan

grants a final decision Approved

Step 9

Step 10 Underwriter reviews your loan and

Closing Team draws final loan documents for grants a final decision

you to sign, issues wire transfer, collects funding

conditions and funds the loan