Page 1 - AAG133_Sequence of Returns Flyer

P. 1

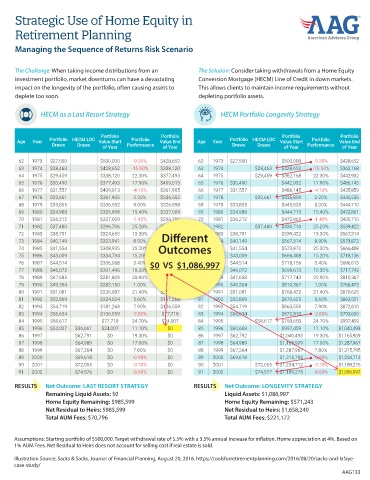

Strategic Use of Home Equity in

Retirement Planning

Managing the Sequence of Returns Risk Scenario

The Challenge: When taking income distributions from an The Solution: Consider taking withdrawals from a Home Equity

investment portfolio, market downturns can have a devastating Conversion Mortgage (HECM) Line of Credit in down markets.

impact on the longevity of the portfolio, often causing assets to This allows clients to maintain income requirements without

deplete too soon. depleting portfolio assets.

HECM as a Last Resort Strategy HECM Portfolio Longevity Strategy

Portfolio Portfolio Portfolio Portfolio

Age Year Portfolio HECM LOC Value Start Portfolio Value End Age Year Portfolio HECM LOC Value Start Portfolio Value End

Draws Draws of Year Performance of Year Draws Draws of Year Performance of Year

62 1973 $27,500 $500,000 -9.30% $428,652 62 1973 $27,500 $500,000 -9.30% $428,652

63 1974 $28,463 $428,652 -15.50% $338,120 63 1974 $28,463 $428,652 -15.50% $362,168

64 1975 $29,459 $338,120 22.30% $377,493 64 1975 $29,459 $362,168 22.30% $442,932

65 1976 $30,490 $377,493 17.90% $409,013 65 1976 $30,490 $442,932 17.90% $486,145

66 1977 $31,557 $409,013 -4.10% $361,905 66 1977 $31,557 $486,145 -4.10% $435,859

67 1978 $32,661 $361,905 2.20% $336,552 67 1978 $32,661 $435,859 2.20% $445,535

68 1979 $33,805 $336,552 8.00% $326,998 68 1979 $33,805 $445,535 8.00% $444,710

69 1980 $34,988 $326,998 15.40% $337,009 69 1980 $34,988 $444,710 15.40% $472,861

70 1981 $36,212 $337,009 -1.40% $296,706 70 1981 $36,212 $472,861 -1.40% $430,710

71 1982 $37,480 $296,706 25.20% $324,655 71 1982 $37,480 $430,710 25.20% $539,422

$323,941

Diff

73t

72 1983 $38,791 $324,655 13.30% $308,935 eren 1983 $38,791 $539,422 13.30% $567,314

72

73 1984 $40,149 $323,941 8.90% 1984 $40,149 $567,314 8.90% $573,872

$334,734

74

74 1985 $41,554 $308,935 25.20% Outcomes 1985 $41,554 $573,872 25.20% $666,408

75 1986 $43,009 $334,734 15.20% $336,068 75 1986 $43,009 $666,408 15.20% $718,156

76

1987

76 1987 $44,514 $336,068 3.40% $0 VS $1,086,997 $44,514 $718,156 3.40% $696,613

$301,496

77 1988 $46,072 $301,496 10.30% $281,809 77 1988 $46,072 $696,613 10.30% $717,742

78 1989 $47,685 $281,809 20.90% $283,150 78 1989 $47,658 $717,742 20.90% $810,367

79 1990 $49,354 $283,150 1.00% $236,087 79 1990 $49,354 $810,367 1.00% $768,472

80 1991 $51,081 $236,087 21.40% $224,524 80 1991 $51,081 $768,472 21.40% $870,625

81 1992 $52,869 $224,524 5.60% $181,268 81 1992 $52,869 $870,625 5.60% $863,551

82 1993 $54,719 $181,268 7.90% $136,559 82 1993 $54,719 $863,551 7.90% $872,810

83 1994 $56,634 $136,559 -2.80% $77,718 83 1994 $56,634 $872,810 -2.80% $793,650

84 1995 $58,617 $77,718 24.70% $24,007 84 1995 $58,617 $793,650 24.70% $997,459

85 1996 $24,007 $36,661 $24,007 11.10% $0 85 1996 $60,668 $997,459 11.10% $1,040,493

86 1997 $62,791 $0 19.30% $0 86 1997 $62,792 $1,040,493 19.30% $1,165,909

87 1998 $64,989 $0 17.00% $0 87 1998 $64,989 $1,165,909 17.00% $1,287,967

88 1999 $67,264 $0 7.80% $0 88 1999 $67,264 $1,287,967 7.80% $1,315,795

89 2000 $69,618 $0 -0.90% $0 89 2000 $69,618 $1,315,795 -0.90% $1,234,712

90 2001 $72,055 $0 -3.70% $0 90 2001 $72,055 $1,234,712 -3.70% $1,189,275

91 2002 $74,576 $0 -8.60% $0 91 2002 $74,577 $1,189,275 -8.60% $1,086,997

RESULTS Net Outcome: LAST RESORT STRATEGY RESULTS Net Outcome: LONGEVITY STRATEGY

Remaining Liquid Assets: $0 Liquid Assets: $1,086,997

Home Equity Remaining: $985,599 Home Equity Remaining: $571,243

Net Residual to Heirs: $985,599 Net Residual to Heirs: $1,658,240

Total AUM Fees: $70,796 Total AUM Fees: $221,172

Assumptions: Starting portfolio of $500,000. Target withdrawal rate of 5.5% with a 3.5% annual increase for inflation. Home appreciation at 4%. Based on

1% AUM Fees. Net Residual to Heirs does not account for selling cost if real estate is sold.

Illustration Source: Sacks & Sacks, Journal of Financial Planning, August 20, 2016. https://toolsforretirementplanning.com/2016/08/20/sacks-and-lafaye-

case-study/

AAG133