Page 1 - AAG073_Open House Flyer

P. 1

Why Settle When You Can Get More?

Own a beautiful home

valued at $300,000 for a

one-time initial payment*

of only $158,838 for cash

8

to close!

If you’re 62 or older, you can

use a Home Equity Conversion

Mortgage (HECM) for Purchase

to buy the home you want —

not the one you’ll settle for.

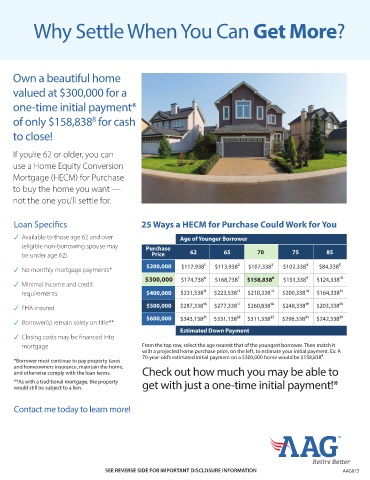

Loan Specifics 25 Ways a HECM for Purchase Could Work for You

3 Available to those age 62 and over Age of Younger Borrower

(eligible non-borrowing spouse may Purchase

be under age 62) Price 62 65 70 75 85

3 No monthly mortgage payments* $200,000 $117,938¹ $113,938² $107,338³ $102,338⁴ $84,338⁵

$300,000 $174,738⁶ $168,738⁷ $158,838⁸ $151,338⁹ $124,338¹⁰

3 Minimal income and credit

requirements $400,000 $231,538¹¹ $223,538¹² $210,338¹³ $200,338¹⁴ $164,338¹⁵

3 FHA-insured $500,000 $287,338¹⁶ $277,338¹⁷ $260,838¹⁸ $248,338¹⁹ $203,338²⁰

$600,000 $343,138²¹ $331,138²² $311,338²³ $296,338²⁴ $242,338²⁵

3 Borrower(s) remain solely on title**

Estimated Down Payment

3 Closing costs may be financed into

mortgage From the top row, select the age nearest that of the youngest borrower. Then match it

with a projected home purchase price, on the left, to estimate your initial payment. Ex: A

70-year-old’s estimated initial payment on a $300,000 home would be $158,838⁸.

*Borrower must continue to pay property taxes

and homeowners insurance, maintain the home,

and otherwise comply with the loan terms. Check out how much you may be able to

**As with a traditional mortgage, the property get with just a one-time initial payment!*

would still be subject to a lien.

Contact me today to learn more!

SEE REVERSE SIDE FOR IMPORTANT DISCLOSURE INFORMATION AAG073