Page 1 - AAG141_Financial Institution Flyer

P. 1

aag.com/forprofessionals

Help Your Members What if you could…

3 Relieve financial stress on your members

Retire Better caused by anticipating retirement income

gaps

3 Provide solutions for your members that are

weighed down by their obligation to sup-

The Challenge port aging parents or family members

1

As 76 million baby boomers near retirement, the nation is facing

an imminent financial crisis. 3 Include strategies for your members around

integrating home equity into retirement

income strategies

Did you know…

Over the past year, 3 out of 10 baby boomers postponed their plans Be the solution to overcoming your

to retire, with 26% anticipating retirement at age 70 or later. members’ retirement crisis

2

The Home Equity Conversion

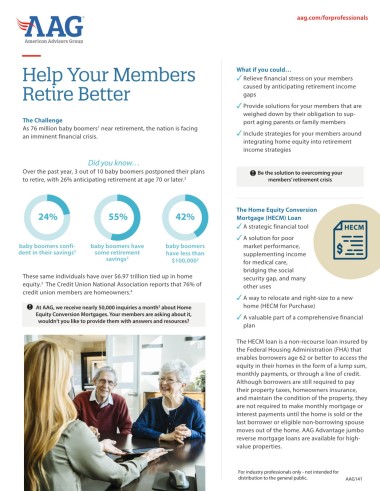

24% 55% 42% Mortgage (HECM) Loan

3 A strategic financial tool

3 A solution for poor

baby boomers confi- baby boomers have baby boomers market performance,

dent in their savings 2 some retirement have less than supplementing income

savings 2 $100,000 2 for medical care,

bridging the social

These same individuals have over $6.97 trillion tied up in home security gap, and many

equity. The Credit Union National Association reports that 76% of other uses

3

credit union members are homeowners. 4

3 A way to relocate and right-size to a new

At AAG, we receive nearly 50,000 inquiries a month about Home home (HECM for Purchase)

5

Equity Conversion Mortgages. Your members are asking about it, 3 A valuable part of a comprehensive financial

wouldn’t you like to provide them with answers and resources?

plan

The HECM loan is a non-recourse loan insured by

the Federal Housing Administration (FHA) that

enables borrowers age 62 or better to access the

equity in their homes in the form of a lump sum,

monthly payments, or through a line of credit.

Although borrowers are still required to pay

their property taxes, homeowners insurance,

and maintain the condition of the property, they

are not required to make monthly mortgage or

interest payments until the home is sold or the

last borrower or eligible non-borrowing spouse

moves out of the home. AAG Advantage jumbo

reverse mortgage loans are available for high-

value properties.

For industry professionals only - not intended for

distribution to the general public. AAG141