Page 95 - BWA Annual Report 2023

P. 95

WESTERN AUSTRALIAN BASKETBALL FEDERATION (INC.)

Notes to the financial statements

for the year ended 31 December 2023

Note

5 Non-financial assets and financial liabilities (cont.)

5.2 Property, plant, and equipment (cont.)

Leasehold improvements are depreciated over the shorter of either the unexpired period of the lease or the estimated useful lives of the improvements.

The carrying amount of plant and equipment is reviewed annually to ensure it is not in excess of the recoverable amount from these assets. The recoverable amount is assessed as the lower of the carrying value and the depreciated replacement cost of an asset. The assets’ residual values and useful lives are reviewed and adjusted, if appropriate, at each balance date.

d. Derecognition and disposal

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These gains and losses and included in the income statement. When revalued assets are sold, amounts included in the revaluation relating to that asset are transferred to retained earnings.

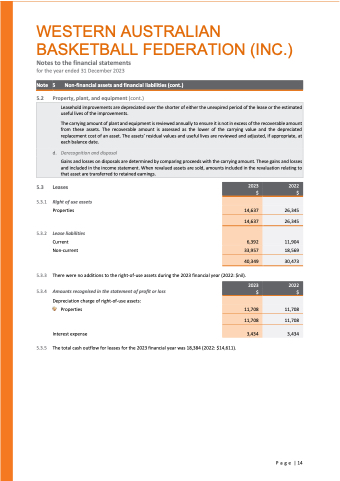

5.3 Leases

5.3.1 Right of use assets Properties

5.3.2 Lease liabilities

Current Non-current

2023 2022 $$

14,637

26,345

14,637

26,345

6,392 33,957

11,904 18,569

40,349

30,473

5.3.3 There were no additions to the right-of-use assets during the 2023 financial year (2022: $nil).

Interest expense

5.3.5 The total cash outflow for leases for the 2023 financial year was 18,384 (2022: $14,611).

5.3.4 Amounts recognised in the statement of profit or loss

Depreciation charge of right-of-use assets:

Properties

2023 2022 $$

11,708

11,708

11,708

11,708

3,434

3,434

P a g e | 14