Page 22 - WCA July Ketch Pen 2020

P. 22

By Shannon Neibergs, WSU Extension Economist

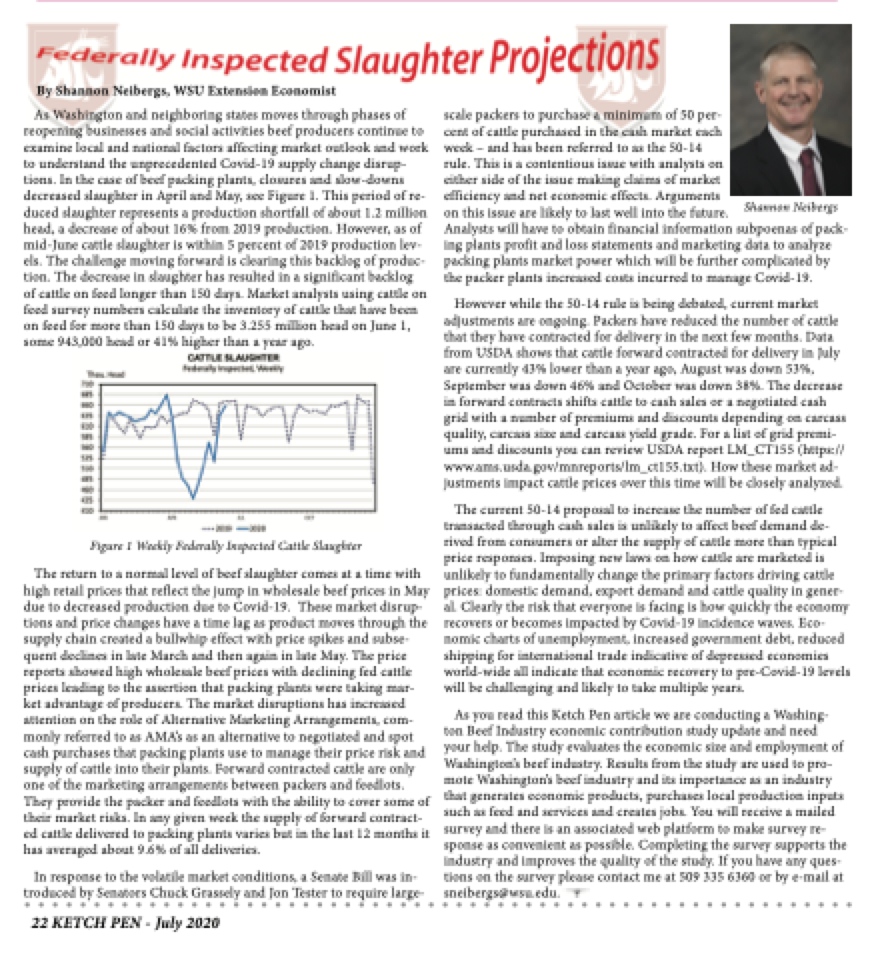

As Washington and neighboring states moves through phases of reopening businesses and social activities beef producers continue to examine local and national factors affecting market outlook and work to understand the unprecedented Covid-19 supply change disrup- tions. In the case of beef packing plants, closures and slow-downs decreased slaughter in April and May, see Figure 1. This period of re- duced slaughter represents a production shortfall of about 1.2 million head, a decrease of about 16% from 2019 production. However, as of mid-June cattle slaughter is within 5 percent of 2019 production lev- els. The challenge moving forward is clearing this backlog of produc- tion. The decrease in slaughter has resulted in a significant backlog

of cattle on feed longer than 150 days. Market analysts using cattle on feed survey numbers calculate the inventory of cattle that have been on feed for more than 150 days to be 3.255 million head on June 1, some 943,000 head or 41% higher than a year ago.

Figure 1 Weekly Federally Inspected Cattle Slaughter

The return to a normal level of beef slaughter comes at a time with high retail prices that reflect the jump in wholesale beef prices in May due to decreased production due to Covid-19. These market disrup- tions and price changes have a time lag as product moves through the supply chain created a bullwhip effect with price spikes and subse- quent declines in late March and then again in late May. The price reports showed high wholesale beef prices with declining fed cattle prices leading to the assertion that packing plants were taking mar- ket advantage of producers. The market disruptions has increased attention on the role of Alternative Marketing Arrangements, com- monly referred to as AMA’s as an alternative to negotiated and spot cash purchases that packing plants use to manage their price risk and supply of cattle into their plants. Forward contracted cattle are only one of the marketing arrangements between packers and feedlots. They provide the packer and feedlots with the ability to cover some of their market risks. In any given week the supply of forward contract- ed cattle delivered to packing plants varies but in the last 12 months it has averaged about 9.6% of all deliveries.

In response to the volatile market conditions, a Senate Bill was in- troduced by Senators Chuck Grassely and Jon Tester to require large-

scale packers to purchase a minimum of 50 per-

cent of cattle purchased in the cash market each

week – and has been referred to as the 50-14

rule. This is a contentious issue with analysts on

either side of the issue making claims of market

efficiency and net economic effects. Arguments

on this issue are likely to last well into the future.

Analysts will have to obtain financial information subpoenas of pack- ing plants profit and loss statements and marketing data to analyze packing plants market power which will be further complicated by the packer plants increased costs incurred to manage Covid-19.

However while the 50-14 rule is being debated, current market adjustments are ongoing. Packers have reduced the number of cattle that they have contracted for delivery in the next few months. Data from USDA shows that cattle forward contracted for delivery in July are currently 43% lower than a year ago, August was down 53%, September was down 46% and October was down 38%. The decrease in forward contracts shifts cattle to cash sales or a negotiated cash grid with a number of premiums and discounts depending on carcass quality, carcass size and carcass yield grade. For a list of grid premi- ums and discounts you can review USDA report LM_CT155 (https:// www.ams.usda.gov/mnreports/lm_ct155.txt). How these market ad- justments impact cattle prices over this time will be closely analyzed.

The current 50-14 proposal to increase the number of fed cattle transacted through cash sales is unlikely to affect beef demand de- rived from consumers or alter the supply of cattle more than typical price responses. Imposing new laws on how cattle are marketed is unlikely to fundamentally change the primary factors driving cattle prices: domestic demand, export demand and cattle quality in gener- al. Clearly the risk that everyone is facing is how quickly the economy recovers or becomes impacted by Covid-19 incidence waves. Eco- nomic charts of unemployment, increased government debt, reduced shipping for international trade indicative of depressed economies world-wide all indicate that economic recovery to pre-Covid-19 levels will be challenging and likely to take multiple years.

As you read this Ketch Pen article we are conducting a Washing- ton Beef Industry economic contribution study update and need your help. The study evaluates the economic size and employment of Washington’s beef industry. Results from the study are used to pro- mote Washington’s beef industry and its importance as an industry that generates economic products, purchases local production inputs such as feed and services and creates jobs. You will receive a mailed survey and there is an associated web platform to make survey re- sponse as convenient as possible. Completing the survey supports the industry and improves the quality of the study. If you have any ques- tions on the survey please contact me at 509 335 6360 or by e-mail at sneibergs@wsu.edu.

Shannon Neibergs

22 KETCH PEN - July 2020