Page 649 - The Principle of Economics

P. 649

CHAPTER 29 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 667

Imports of goods and services exceeded exports. In 1998, the trade deficit was $151 billion, or about 1.8 percent of GDP.

Are these trade deficits a problem for the U.S. economy? Most economists believe that they are not a problem in themselves, but perhaps are a symptom of a problem—reduced national saving. Reduced national saving is potentially a problem because it means that the nation is putting away less to provide for its future. Once national saving has fallen, however, there is no reason to de- plore the resulting trade deficits. If national saving fell without inducing a trade deficit, investment in the United States would have to fall. This fall in invest- ment, in turn, would adversely affect the growth in the capital stock, labor

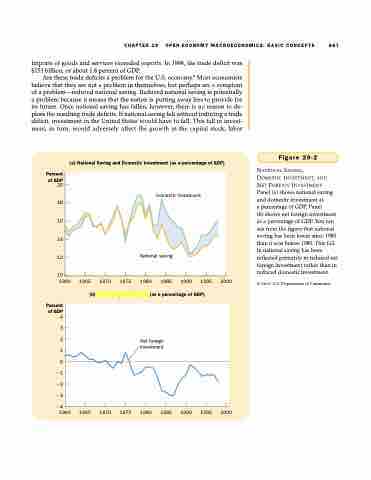

(a) National Saving and Domestic Investment (as a percentage of GDP)

18

16

14

12

10

1960 1965

Percent of GDP 4

3 2 1 0

1 2 3

4

1960 1965

Figure 29-2

NATIONAL SAVING,

DOMESTIC INVESTMENT, AND

NET FOREIGN INVESTMENT.

Panel (a) shows national saving and domestic investment as

a percentage of GDP. Panel

(b) shows net foreign investment as a percentage of GDP. You can see from the figure that national saving has been lower since 1980 than it was before 1980. This fall in national saving has been reflected primarily in reduced net foreign investment rather than in reduced domestic investment.

SOURCE: U.S. Department of Commerce.

Domestic investment

National saving

Percent of GDP

20

1980 1985 1990 1995 2000 (b) Net Foreign Investment (as a percentage of GDP)

1970 1975

Net foreign investment

1970 1975

1980 1985 1990 1995 2000