Page 668 - The Principle of Economics

P. 668

686

PART ELEVEN

THE MACROECONOMICS OF OPEN ECONOMIES

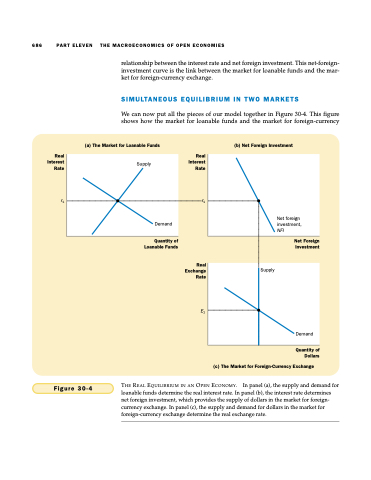

relationship between the interest rate and net foreign investment. This net-foreign- investment curve is the link between the market for loanable funds and the mar- ket for foreign-currency exchange.

SIMULTANEOUS EQUILIBRIUM IN TWO MARKETS

We can now put all the pieces of our model together in Figure 30-4. This figure shows how the market for loanable funds and the market for foreign-currency

(a) The Market for Loanable Funds

Real Real Interest Interest Rate Rate

r1 r1

(b) Net Foreign Investment

Supply

Demand

Net foreign investment, NFI

Quantity of Loanable Funds

Net Foreign Investment

Supply

Demand

Real Exchange Rate

E1

(c) The Market for Foreign-Currency Exchange

Quantity of Dollars

THE REAL EQUILIBRIUM IN AN OPEN ECONOMY. In panel (a), the supply and demand for loanable funds determine the real interest rate. In panel (b), the interest rate determines net foreign investment, which provides the supply of dollars in the market for foreign- currency exchange. In panel (c), the supply and demand for dollars in the market for foreign-currency exchange determine the real exchange rate.

Figure 30-4