Page 25 - Introduction to Programming with Java: A Problem Solving Approach

P. 25

xxiv Project Summary

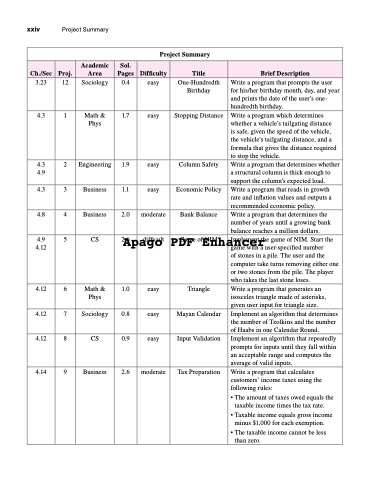

Project Summary

Ch./Sec

Proj.

Academic Area

Sol. Pages

Difficulty

Title

Brief Description

3.23

12

Sociology

0.4

easy

One-Hundredth Birthday

Write a program that prompts the user for his/her birthday month, day, and year and prints the date of the user’s one- hundredth birthday.

4.3

1

Math & Phys

1.7

easy

Stopping Distance

Write a program which determines whether a vehicle’s tailgating distance is safe, given the speed of the vehicle, the vehicle’s tailgating distance, and a formula that gives the distance required to stop the vehicle.

4.3 4.9

2

Engineering

1.9

easy

Column Safety

Write a program that determines whether a structural column is thick enough to support the column’s expected load.

4.3

3

Business

1.1

easy

Economic Policy

Write a program that reads in growth rate and inflation values and outputs a recommended economic policy.

4.8

4

Business

2.0

moderate

Bank Balance

Write a program that determines the number of years until a growing bank balance reaches a million dollars.

4.9 4.12

5

CS

2.6 difficult

Apago

Game of NIM Implement the game of NIM. Start the

PDF Enhancer

game with a user-specified number

of stones in a pile. The user and the computer take turns removing either one or two stones from the pile. The player who takes the last stone loses.

4.12

6

Math & Phys

1.0

easy

Triangle

Write a program that generates an isosceles triangle made of asterisks, given user input for triangle size.

4.12

7

Sociology

0.8

easy

Mayan Calendar

Implement an algorithm that determines the number of Tzolkins and the number of Haabs in one Calendar Round.

4.12

8

CS

0.9

easy

Input Validation

Implement an algorithm that repeatedly prompts for inputs until they fall within an acceptable range and computes the average of valid inputs.

4.14

9

Business

2.6

moderate

Tax Preparation

Write a program that calculates customers’ income taxes using the following rules:

• The amount of taxes owed equals the

taxable income times the tax rate.

• Taxable income equals gross income

minus $1,000 for each exemption.

• The taxable income cannot be less than zero.