Page 13 - Annual Report

P. 13

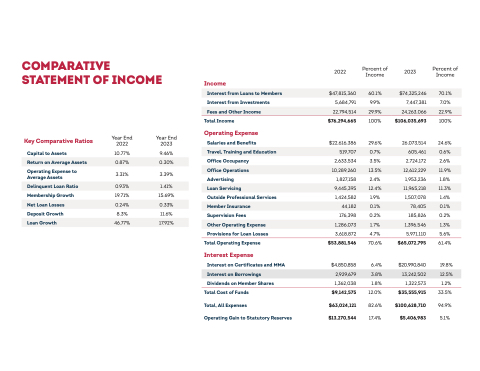

COMPARATIVE STATEMENT OF INCOME

2022

5,684,791

Salaries and Benefits

Office Occupancy

Advertising 1,827,158

Percent of Income

9.9%

29.6% 3.5% 2.4% 1.9% 0.2% 4.7%

6.4% 1.8%

82.6% 17.4%

2023

7,447,381

26,073,514 2,724,172 1,953,236 1,507,078 185,826 5,971,110

$20,990,840 1,322,573

$100,628,710 $5,406,983

Percent of Income

7.0%

24.6% 2.6% 1.8% 1.4% 0.2% 5.6%

19.8% 1.2%

94.9% 5.1%

Interest from Loans to Members

$47,815,360

60.1%

$74,325,246

70.1%

Fees and Other Income

22,794,514

29.9%

24,263,066

22.9%

Total Income

$76,294,665

100%

$106,035,693

100%

Key Comparative Ratios

Capital to Assets

Operating Expense to Average Assets

Membership Growth Deposit Growth

$22,616,386 2,633,534

Year End 2022

10.77%

3.31%

19.71% 8.3%

Year End 2023

9.46%

3.39%

15.69% 11.6%

Income

Interest from Investments

Operating Expense

Travel, Training and Education

519,707

0.7%

605,461

0.6%

Return on Average Assets

0.87%

0.30%

Office Operations

10,289,260

13.5%

12,612,229

11.9%

Delinquent Loan Ratio

0.93%

1.41%

Loan Servicing

9,445,395

12.4%

11,965,218

11.3%

Outside Professional Services Supervision Fees

Provisions for Loan Losses

Interest Expense

Interest on Certificates and MMA Dividends on Member Shares

Total, All Expenses

Operating Gain to Statutory Reserves

1,424,582 176,398 3,618,872

$4,850,858 1,362,038

$63,024,121 $13,270,544

Net Loan Losses

0.24%

0.33%

Member Insurance

44,182

0.1%

78,405

0.1%

Loan Growth

46.77%

17.92%

Other Operating Expense

1,286,073

1.7%

1,396,546

1.3%

Total Operating Expense

$53,881,546

70.6%

$65,072,795

61.4%

Interest on Borrowings

2,929,679

3.8%

13,242,502

12.5%

Total Cost of Funds

$9,142,575

12.0%

$35,555,915

33.5%