Page 138 - NIB Annual Report 12-13 | 13-14

P. 138

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

19. Related party balances and transactions, continued

Per the Ordinance, contributions from TCIG of US$1,201,220 (2013 – US$1,021,301) comprise contributions relating to TCIG officers only and these are reflected in the statement of income, expenses and reserves as contributions from civil servants. Contributions for TCIG employees are charged at the same rates as the private sector and, on this basis, have been included within the private sector contributions in the

statement of income, expenses and reserves and for the purpose contributions amongst branches.

of allocating

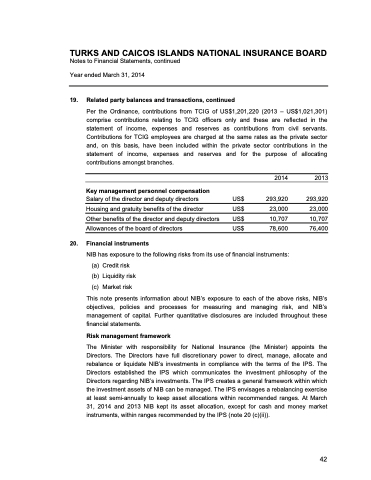

2013

293,920 23,000 10,707 76,400

Key management personnel compensation

Salary of the director and deputy directors US$ Housing and gratuity benefits of the director US$ Other benefits of the director and deputy directors US$ Allowances of the board of directors US$

20. Financial instruments

2014

293,920 23,000 10,707 78,600

NIB has exposure to the following risks from its use of financial instruments: (a) Credit risk

(b) Liquidity risk

(c) Marketrisk

This note presents information about NIB’s exposure to each of the above risks, NIB’s objectives, policies and processes for measuring and managing risk, and NIB’s management of capital. Further quantitative disclosures are included throughout these financial statements.

Risk management framework

The Minister with responsibility for National Insurance (the Minister) appoints the Directors. The Directors have full discretionary power to direct, manage, allocate and rebalance or liquidate NIB’s investments in compliance with the terms of the IPS. The Directors established the IPS which communicates the investment philosophy of the Directors regarding NIB’s investments. The IPS creates a general framework within which the investment assets of NIB can be managed. The IPS envisages a rebalancing exercise at least semi-annually to keep asset allocations within recommended ranges. At March 31, 2014 and 2013 NIB kept its asset allocation, except for cash and money market instruments, within ranges recommended by the IPS (note 20 (c)(ii)).

134| The National Insurance Board of The Turks and Caicos Islands

42