Page 149 - NIB Annual Report 12-13 | 13-14

P. 149

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

20. Financial instruments, continued

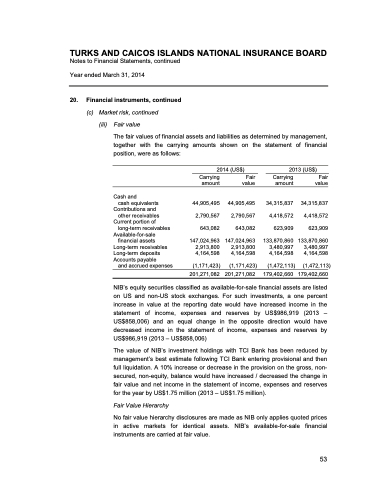

(c) Market risk, continued (iii) Fair value

The fair values of financial assets and liabilities as determined by management, together with the carrying amounts shown on the statement of financial position, were as follows:

Cash and

cash equivalents

Contributions and other receivables

Current portion of long-term receivables

Available-for-sale financial assets

Long-term receivables Long-term deposits Accounts payable

and accrued expenses

Carrying amount

34,315,837

4,418,572

623,909

133,870,860 3,480,997 4,164,598

Fair value

34,315,837 4,418,572 623,909

133,870,860 3,480,997 4,164,598

Carrying amount

44,905,495

2,790,567

643,082

147,024,963 2,913,800 4,164,598

(1,171,423) 201,271,082

Fair value

44,905,495

2,790,567

643,082

147,024,963 2,913,800 4,164,598

(1,171,423)

201,271,082 179,402,660 179,402,660

2014 (US$)

2013 (US$)

(1,472,113)

(1,472,113)

NIB’s equity securities classified as available-for-sale financial assets are listed on US and non-US stock exchanges. For such investments, a one percent increase in value at the reporting date would have increased income in the statement of income, expenses and reserves by US$986,919 (2013 – US$858,006) and an equal change in the opposite direction would have decreased income in the statement of income, expenses and reserves by US$986,919 (2013 – US$858,006)

The value of NIB’s investment holdings with TCI Bank has been reduced by management’s best estimate following TCI Bank entering provisional and then full liquidation. A 10% increase or decrease in the provision on the gross, non- secured, non-equity, balance would have increased / decreased the change in fair value and net income in the statement of income, expenses and reserves for the year by US$1.75 million (2013 – US$1.75 million).

Fair Value Hierarchy

No fair value hierarchy disclosures are made as NIB only applies quoted prices in active markets for identical assets. NIB’s available-for-sale financial instruments are carried at fair value.

2013 & 2014 ANNUAL REPORT |145 53