Page 15 - NIB Annual Report 12-13 | 13-14

P. 15

Operations

Financing National Insurance

The TCI National Insurance Fund (NIF) is relatively young and will soon be going through a period of rapid increase in the number of pensioners and the amount of pensions that will be paid. It is projected to reach a state of maturity within the next 50 to 60 years as the pay as you go rate and ratio of contributors to pensioners start to stabilize.

The NIB sources of income to fund benefits comes from contributions received from employees, employers, self employed persons, investment earnings on the reserves and penalty charges (also referred to as surcharges). The penalty charges are relatively small and have minimal impact on Total Fund Income. All insured persons and employees between the ages of 16 and 65 who are gainfully employed, are required to contribute to the plan. The program provides a wide range of benefits including various pensions, grants and payments.

The average unemployment rate for the period 2001 to 2008 was 7.8%, but in recent years the average unemployment rate has grown significantly reaching 17.2% in the fiscal year 2012/13. These high levels of unemployment have lead to a significant decrease in the employed population, directly affecting the number of active contributors and the contribution earnings base of the NIB.

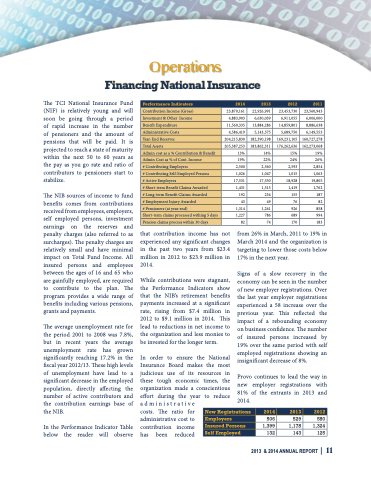

In the Performance Indicator Table below the reader will observe

23,870,161

4,883,903

11,560,335

4,586,419

204,215,830

205,387,253

13%

19%

2,500

1,026

17,531

1,431

192

43

1,314

1,227

82

22,926,991

6,630,039

13,884,286

5,143,575

182,390,198

183,862,311

14%

22%

2,560

1,047

17,550

1,515

234

49

1,261

786

74

23,453,730

6,911,055

14,859,801

5,689,750

169,231,105

176,262,636

15%

24%

2,593

1,015

18,928

1,419

155

76

926

689

170

23,560,943 6,006,000 8,886,638 6,149,553

160,727,278 162,273,068 19% 26% 2,854 1,063 19,805 1,762 187 82 858 994 183

Performance Indicators

2014

2013

2012

2011

Contribution Income (Gross)

Investment & Other Income

Benefit Expenditure

Administrative Costs

Year-End Reserves

Total Assets

Admin cost as a % Contribution & Benefit

Admin Cost as % of Cont. Income

# Contributing Employers

# Contributing Self-Employed Persons

# Active Employees

# Short-term Benefit Claims Awarded

# Long-term Benefit Claims Awarded

# Employment Injury Awarded

# Pensioners (at year-end)

Short-term claims processed withing 5 days

Pension claims process within 30 days

that contribution income has not experienced any significant changes in the past two years from $23.4 million in 2012 to $23.9 million in 2014.

While contributions were stagnant, the Performance Indicators show that the NIB’s retirement benefits payments increased at a significant rate, rising from $7.4 million in 2012 to $9.1 million in 2014. This lead to reductions in net income to the organization and less monies to be invested for the longer term.

In order to ensure the National Insurance Board makes the most judicious use of its resources in these tough economic times, the organization made a conscientious effort during the year to reduce administrative

costs. The ratio for administrative cost to contribution income has been reduced

from 26% in March, 2011 to 19% in March 2014 and the organization is targeting to lower those costs below 17% in the next year.

Signs of a slow recovery in the economy can be seen in the number of new employer registrations. Over the last year employer registrations experienced a 58 increase over the previous year. This reflected the impact of a rebounding economy on business confidence. The number of insured persons increased by 19% over the same period with self employed registrations showing an insignificant decrease of 8%.

Provo continues to lead the way in new employer registrations with 81% of the entrants in 2013 and 2014.

506 529 580

1,399 1,178 1,324

132 143 125

New Registrations

2014

2013

2012

Employers

Insured Persons

Self Employed

2013 & 2014 ANNUAL REPORT | 11