Page 152 - NIB Annual Report 12-13 | 13-14

P. 152

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2014

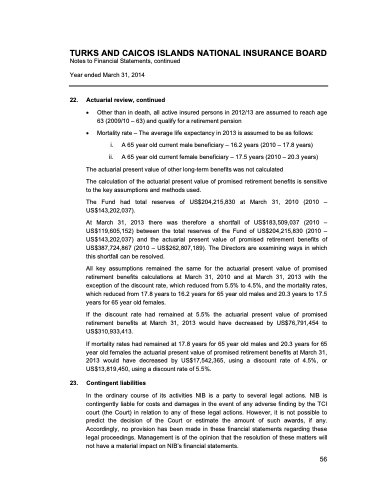

22. Actuarial review, continued

Other than in death, all active insured persons in 2012/13 are assumed to reach age 63 (2009/10 – 63) and qualify for a retirement pension

Mortality rate – The average life expectancy in 2013 is assumed to be as follows:

i. A 65 year old current male beneficiary – 16.2 years (2010 – 17.8 years)

ii. A 65 year old current female beneficiary – 17.5 years (2010 – 20.3 years)

The actuarial present value of other long-term benefits was not calculated

The calculation of the actuarial present value of promised retirement benefits is sensitive to the key assumptions and methods used.

The Fund had total reserves of US$204,215,830 at March 31, 2010 (2010 – US$143,202,037).

At March 31, 2013 there was therefore a shortfall of US$183,509,037 (2010 – US$119,605,152) between the total reserves of the Fund of US$204,215,830 (2010 – US$143,202,037) and the actuarial present value of promised retirement benefits of US$387,724,867 (2010 – US$262,807,189). The Directors are examining ways in which this shortfall can be resolved.

All key assumptions remained the same for the actuarial present value of promised retirement benefits calculations at March 31, 2010 and at March 31, 2013 with the exception of the discount rate, which reduced from 5.5% to 4.5%, and the mortality rates, which reduced from 17.8 years to 16.2 years for 65 year old males and 20.3 years to 17.5 years for 65 year old females.

If the discount rate had remained at 5.5% the actuarial present value of promised retirement benefits at March 31, 2013 would have decreased by US$76,791,454 to US$310,933,413.

If mortality rates had remained at 17.8 years for 65 year old males and 20.3 years for 65 year old females the actuarial present value of promised retirement benefits at March 31, 2013 would have decreased by US$17,542,365, using a discount rate of 4.5%, or US$13,819,450, using a discount rate of 5.5%.

23. Contingent liabilities

In the ordinary course of its activities NIB is a party to several legal actions. NIB is contingently liable for costs and damages in the event of any adverse finding by the TCI court (the Court) in relation to any of these legal actions. However, it is not possible to predict the decision of the Court or estimate the amount of such awards, if any. Accordingly, no provision has been made in these financial statements regarding these legal proceedings. Management is of the opinion that the resolution of these matters will

not have a material impact on NIB’s financial statements.

148| The National Insurance Board of The Turks and Caicos Islands

56