Page 44 - NIB Annual Report 12-13 | 13-14

P. 44

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

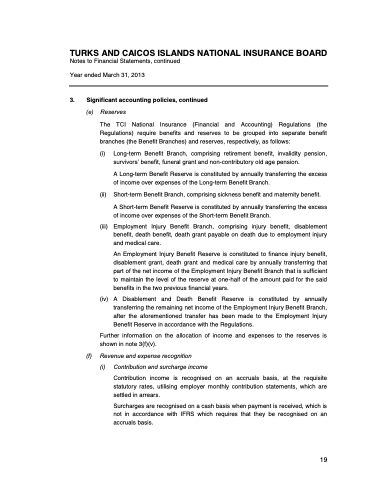

3. Significant accounting policies, continued

(e) Reserves

The TCI National Insurance (Financial and Accounting) Regulations (the Regulations) require benefits and reserves to be grouped into separate benefit branches (the Benefit Branches) and reserves, respectively, as follows:

(i) Long-term Benefit Branch, comprising retirement benefit, invalidity pension, survivors’ benefit, funeral grant and non-contributory old age pension.

A Long-term Benefit Reserve is constituted by annually transferring the excess of income over expenses of the Long-term Benefit Branch.

(ii) Short-term Benefit Branch, comprising sickness benefit and maternity benefit.

A Short-term Benefit Reserve is constituted by annually transferring the excess of income over expenses of the Short-term Benefit Branch.

(iii) Employment Injury Benefit Branch, comprising injury benefit, disablement benefit, death benefit, death grant payable on death due to employment injury and medical care.

An Employment Injury Benefit Reserve is constituted to finance injury benefit, disablement grant, death grant and medical care by annually transferring that part of the net income of the Employment Injury Benefit Branch that is sufficient to maintain the level of the reserve at one-half of the amount paid for the said benefits in the two previous financial years.

(iv) A Disablement and Death Benefit Reserve is constituted by annually transferring the remaining net income of the Employment Injury Benefit Branch, after the aforementioned transfer has been made to the Employment Injury Benefit Reserve in accordance with the Regulations.

Further information on the allocation of income and expenses to the reserves is shown in note 3(f)(v).

(f) Revenue and expense recognition

(i) Contribution and surcharge income

Contribution income is recognised on an accruals basis, at the requisite statutory rates, utilising employer monthly contribution statements, which are settled in arrears.

Surcharges are recognised on a cash basis when payment is received, which is not in accordance with IFRS which requires that they be recognised on an accruals basis.

40 | The National Insurance Board of The Turks and Caicos Islands

19