Page 47 - NIB Annual Report 12-13 | 13-14

P. 47

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

3. Significant accounting policies, continued

(f) Revenue and expense recognition, continued

(v) Basis of apportionment of income and expense, continued

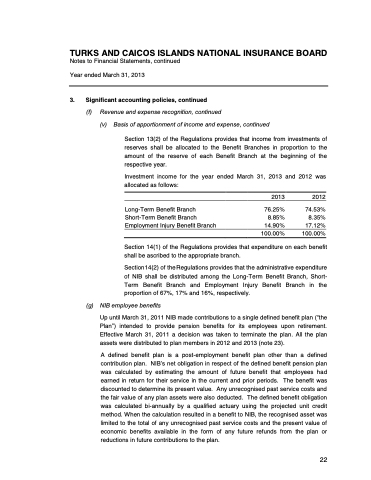

Section 13(2) of the Regulations provides that income from investments of reserves shall be allocated to the Benefit Branches in proportion to the amount of the reserve of each Benefit Branch at the beginning of the respective year.

Investment income for the year ended March 31, 2013 and 2012 was allocated as follows:

2013

2012

74.53% 8.35% 17.12% 100.00%

Long-Term Benefit Branch

Short-Term Benefit Branch

Employment Injury Benefit Branch 14.90%

100.00%

76.25% 8.85%

Section 14(1) of the Regulations provides that expenditure on each benefit shall be ascribed to the appropriate branch.

Section14(2) of theRegulations provides that the administrative expenditure of NIB shall be distributed among the Long-Term Benefit Branch, Short- Term Benefit Branch and Employment Injury Benefit Branch in the proportion of 67%, 17% and 16%, respectively.

(g) NIB employee benefits

Up until March 31, 2011 NIB made contributions to a single defined benefit plan (“the Plan”) intended to provide pension benefits for its employees upon retirement. Effective March 31, 2011 a decision was taken to terminate the plan. All the plan assets were distributed to plan members in 2012 and 2013 (note 23).

A defined benefit plan is a post-employment benefit plan other than a defined contribution plan. NIB’s net obligation in respect of the defined benefit pension plan was calculated by estimating the amount of future benefit that employees had earned in return for their service in the current and prior periods. The benefit was discounted to determine its present value. Any unrecognised past service costs and the fair value of any plan assets were also deducted. The defined benefit obligation was calculated bi-annually by a qualified actuary using the projected unit credit method. When the calculation resulted in a benefit to NIB, the recognised asset was limited to the total of any unrecognised past service costs and the present value of economic benefits available in the form of any future refunds from the plan or reductions in future contributions to the plan.

2013 & 2014 ANNUAL REPORT | 43 22