Page 65 - NIB Annual Report 12-13 | 13-14

P. 65

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

12. Investment property – net, continued

The investment property comprised 0.52 acres of land and a building located on Grand Turk known as the Hon. N.J.S. Francis Building. The property was leased to TCIG from February 1, 2005 to February 1, 2010 (the initial lease period) for an annual rental of US$552,360 per a lease agreement dated November 30, 2007 (the Agreement).

Under the Agreement TCIG had the right to either renew the lease for another seven years on the same terms and conditions contained in the original lease agreement with a revised annual rental fee of US$692,400 or purchase the property at the end of the initial lease period for a total consideration of US$4,116,173. TCIG did not exercise the option to purchase the property. The extension of the lease for another seven years until June 30, 2017 was under negotiation until November 2011, at which time TCIG expressed its desire to purchase the Hon. N.J.S. Francis building for the current market value of the property. On November 5, 2012 NIB agreed to sell the Hon. N.J.S. Francis building and associated land to TCIG for US$5.9 million as part of the Omnibus Agreement (note 24).

The cost of land included in investment property was US$1. The land was purchased from TCIG on April 16, 2007.

The fair value of the investment property including land at November 5, 2012 and March 31, 2012 was approximately US$5,900,000 based on a valuation conducted in June 2012 by an external, independent valuation company, with recognised and relevant professional qualifications and recent experience in the location and category of property being valued. The valuation company determined the fair value using a combination of a comparable approach for valuing the land and a cost approach for valuing improvements.

During the year ended March 31, 2013 NIB recognised rental income of US$368,240 (2012 – US$552,360) (note 18) and direct expenses of US$75,127 (2012 – US$136,886) (note 21) in relation to this property.

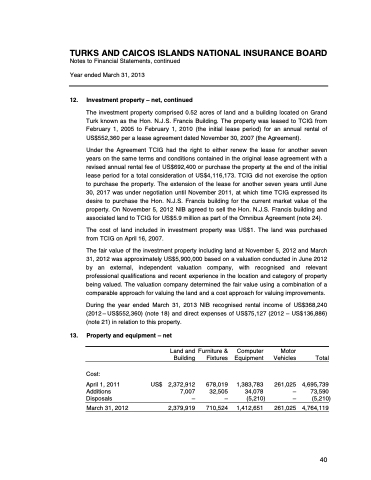

13. Property and equipment – net

Land and

Building

Cost:

April 1, 2011 US$ 2,372,912 Additions 7,007 Disposals –

March 31, 2012 2,379,919

Furniture & Fixtures

678,019 32,505 –

710,524

Computer Equipment

1,383,783 34,078

(5,210) 1,412,651

Motor Vehicles

261,025 – –

261,025

T otal

4,695,739 73,590

(5,210) 4,764,119

2013 & 2014 ANNUAL REPORT | 61 40