Page 70 - NIB Annual Report 12-13 | 13-14

P. 70

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

16. Contributions

On December 22, 2011, a two month amnesty period was announced on unpaid NIB surcharges provided contributors brought their contributions fully up to date. As a result of this amnesty, US$12,139,856 of surcharges in total comprising US$11,855,351 of surcharges due from TCIG and US$284,505 of surcharges due from the private sector and the self-employed were written-off as a consequence of TCIG and members of the private sector taking advantage of the amnesty to bring their contributions up to date.

As NIB accounts for its surcharges on a cash basis of accounting rather than an accruals basis neither the surcharge income nor the surcharges written-off as a result of the amnesty were recorded in the statement of income, expenses and reserves for the year ended March 31, 2013.

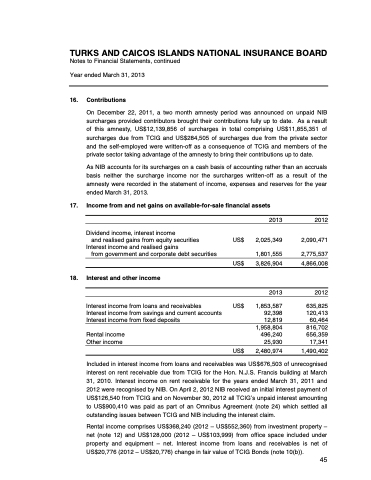

17. Income from and net gains on available-for-sale financial assets

Dividend income, interest income

and realised gains from equity securities

Interest income and realised gains

from government and corporate debt securities

18. Interest and other income

Interest income from loans and receivables Interest income from savings and current accounts Interest income from fixed deposits

Rental income Other income

US$ US$

US$

US$

2013

2,025,349

1,801,555 3,826,904

2013

1,853,587 92,398 12,819 1,958,804 496,240 25,930

2,480,974

2012

2,090,471

2,775,537 4,866,008

2012

635,825 120,413 60,464 816,702 656,359 17,341

1,490,402

Included in interest income from loans and receivables was US$676,503 of unrecognised interest on rent receivable due from TCIG for the Hon. N.J.S. Francis building at March 31, 2010. Interest income on rent receivable for the years ended March 31, 2011 and 2012 were recognised by NIB. On April 2, 2012 NIB received an initial interest payment of US$126,540 from TCIG and on November 30, 2012 all TCIG’s unpaid interest amounting to US$900,410 was paid as part of an Omnibus Agreement (note 24) which settled all outstanding issues between TCIG and NIB including the interest claim.

45

Rental income comprises US$368,240 (2012 – US$552,360) from investment property – net (note 12) and US$128,000 (2012 – US$103,999) from office space included under property and equipment – net. Interest income from loans and receivables is net of

66 | The National Insurance Board of The Turks and Caicos Islands

US$20,776 (2012 – US$20,776) change in fair value of TCIG Bonds (note 10(b)).