Page 80 - NIB Annual Report 12-13 | 13-14

P. 80

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

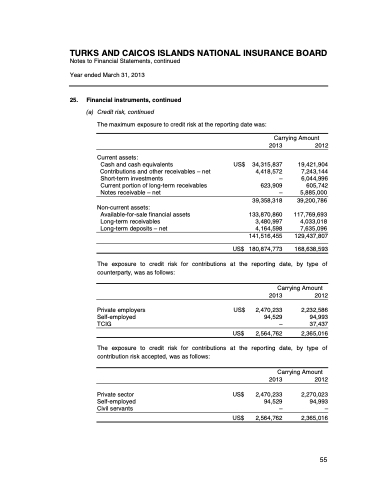

25. Financial instruments, continued

(a) Credit risk, continued

The maximum exposure to credit risk at the reporting date was:

Carrying Amount

Current assets:

Cash and cash equivalents

Contributions and other receivables – net Short-term investments

Current portion of long-term receivables Notes receivable – net

Non-current assets: Available-for-sale financial assets Long-term receivables

Long-term deposits – net

US$

2013

34,315,837 4,418,572 – 623,909 – 39,358,318

133,870,860 3,480,997 4,164,598

2012

19,421,904 7,243,144 6,044,996

605,742 5,885,000 39,200,786

117,769,693 4,033,018 7,635,096

129,437,807 168,638,593

141,516,455 US$ 180,874,773

The exposure to credit risk for contributions at the reporting date, by type of counterparty, was as follows:

Carrying Amount

2013

Private employers US$ 2,470,233 Self-employed 94,529 TCIG –

US$ 2,564,762

2012

2,232,586 94,993 37,437

2,365,016

The exposure to credit risk for contributions at the reporting date, by type of contribution risk accepted, was as follows:

Carrying Amount

2013

Private sector US$ 2,470,233 Self-employed 94,529 Civil servants –

2012

2,270,023 94,993 –

US$ 2,564,762 2,365,016

76 | The National Insurance Board of The Turks and Caicos Islands

55