Page 111 - Demo

P. 111

For Q4 of FY 2019-20, the Risk Management Committee had approved write-offs to the tune of `1,936 Lakhs. These were advances which were provided for in full and where no recoveries had been made in the recent past. Further, the Bank is of the opinion that these advances have low probability of recovery. A summary of write off made in the current financial year is given as under:

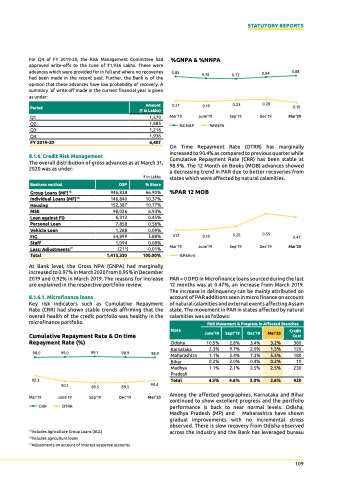

%gnPa & %nnPa

0.85

0.21

Mar'19 %GNAP

0.74 0.72 0.84 0.88

STATUTORY REPORTS

0.28 June'19 Sep'19 Dec'19

%NNPA

Period

amount (` in Lakhs)

Q1

Q2

Q3

Q4

fy 2019-20

8.1.6. credit risk Management

1,570

1,685 1,216 1,936 6,407

On Time Repayment Rate (OTRR) has marginally increased to 90.4% as compared to previous quarter while Cumulative Repayment Rate (CRR) has been stable at 98.9%. The 12 Month on Books (MOB) advances showed a decreasing trend in PAR due to better recoveries from states which were affected by natural calamities.

0.19

0.23

0.10

Mar'20

The overall distribution of gross advances as at March 31, 2020 was as under:

business vertical

osP

% share

group Loans (Mf)15

individual Loans (Mf)16

946,838

146,840

` in Lakhs

66.90%

10.37%

10.77%

6.93%

0.45%

0.56%

0.09%

3.88%

0.08%

-0.01%

%Par 12 Mob

017 0.19

housing 152,387

Mse 98,026

Loan against fd

Personal Loan

vehicle Loan

6,312

7,858

1,288

0.26 Sep'19

0.55

Dec'19 Mar'20

fig 54,899

Staff 1,094

Less: adjustments17 (211)

0.47

Mar'19 %PAR>0

June'19

total 1,415,330 100.00%

At Bank level, the Gross NPA (GNPA) had marginally increased to 0.97% in March 2020 from 0.95% in December 2019 and 0.92% in March 2019. The reasons for increase are explained in the respective portfolio review.

8.1.6.1. Microfinance loans

Key risk indicators such as Cumulative Repayment Rate (CRR) had shown stable trends affirming that the overall health of the credit portfolio was healthy in the microfinance portfolio.

pAR > 0 DpD in Microfinance loans sourced during the last 12 months was at 0.47%, an increase from March 2019. The increase in delinquency can be mainly attributed on account of pAR additions seen in micro finance on account ofnaturalcalamitiesandexternaleventsaffectingAssam state. the movement in pAR in states affected by natural calamities was as follows:

cumulative repayment rate & on time repayment rate (%)

Odisha

Karnataka Maharashtra

Bihar

Madhya Pradesh total

10.5% 2.8% 3.4% 380

2.3% 9.7% 2.0% 120

1.1% 2.4% 7.3% 180

0.2% 2.0% 0.4% 10

1.1% 2.1% 2.5% 230

4.3% 4.6% 3.0% 920

98.0

92.3 Mar'19

99.0

90.1 June'19

99.1 98.9

89.5 89.5 Sep'19 Dec'19

98.9

90.4

Mar'20

Among the affected geographies, Karnataka and Bihar continued to show excellent progress and the portfolio performance is back to near normal levels. Odisha, Madhya Pradesh (MP) and Maharashtra have shown gradual improvements with no incremental stress observed. There is slow recovery from Odisha observed across the industry and the Bank has leveraged bureau

Par Movement & Progress in affected branches

state

June’19

sept’19

dec’19

Mar’20

credit cost

3.2%

1.5%

5.5%

0.2%

2.5%

2.6%

CRR OTRR

15Includes Agriculture Group Loans (AGL)

16Includes agriculture loans

17Adjustments on account of interest suspense accounts

109