Page 133 - Demo

P. 133

Particulars

net profit Operating Expenses

Provisions and Contingencies

Gross Income

Average (3 years)

686 65,287

31,276

97,249

19,922 100,335

10,980

131,237 141,356

(` in Lakhs)

(387) 387

- -

(387) 387

Mar-18

Mar-19

` in Lakhs

Mar-20

STATUTORY REPORTS

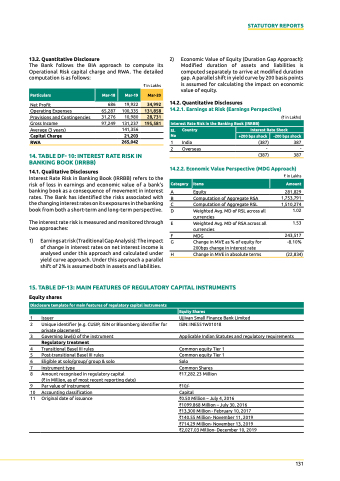

13.2. Quantitative disclosure

The Bank follows the BIA approach to compute its Operational Risk capital charge and RWA. The detailed computation is as follows:

2) Economic Value of Equity (Duration Gap Approach): Modified duration of assets and liabilities is computed separately to arrive at modified duration gap. A parallel shift in yield curve by 200 basis points is assumed for calculating the impact on economic value of equity.

14.2. Quantitative disclosures

14.2.1. earnings at risk (earnings Perspective)

34,992

131,858

28,731

195,581

interest rate risk in the banking book (irrbb)

sl. no

country

interest rate shock

+200 bps shock

-200 bps shock

capital charge

rWa 265,042

14. Table DF- 10: inTereST raTe riSk in bankinG book (irrbb)

14.1. Qualitative disclosures

21,203

1 India

2 Overseas

Interest Rate Risk in Banking Book (IRRBB) refers to the risk of loss in earnings and economic value of a bank’s banking book as a consequence of movement in interest rates. the Bank has identified the risks associated with the changing interest rates on its exposures in the banking book from both a short-term and long-term perspective.

The interest rate risk is measured and monitored through two approaches:

1) Earnings at risk (Traditional Gap Analysis): The impact of change in interest rates on net interest income is analysed under this approach and calculated under yield curve approach. Under this approach a parallel shift of 2% is assumed both in assets and liabilities.

14.2.2. economic value Perspective (Mdg approach)

` in Lakhs

A Equity 281,829

B Computation of Aggregate RSA 1,753,791

C Computation of Aggregate RSL 1,510,274

D Weighted Avg. MD of RSL across all 1.02 currencies

E Weighted Avg. MD of RSA across all 1.53 currencies

F MDG 243,517

category

items

amount

G Change in MVE as % of equity for 200bps change in interest rate

H Change in MVE in absolute terms

-8.10% (22,834)

15. Table DF-13: Main FeaTureS oF reGulaTory caPiTal inSTruMenTS

equity shares

1 Issuer

2 unique identifier (e.g. CuSIp, ISIn or Bloomberg identifier for private placement)

3 Governing law(s) of the instrument

regulatory treatment

4 Transitional Basel III rules

5 Post-transitional Basel III rules

6 Eligible at solo/group/ group & solo

7 Instrument type

8 Amount recognised in regulatory capital

(` in Million, as of most recent reporting date)

9 Par value of instrument

10 Accounting classification

11 Original date of issuance

Ujjivan Small Finance Bank Limited ISIN: INE551W01018

Applicable Indian Statutes and regulatory requirements

Common equity Tier 1 Common equity Tier 1 Solo

Common Shares `17,282.23 Million

`10/-

Capital

`0.50 Million – July 4, 2016 `1099.868 Million – July 30, 2016 `13,300 Million - February 10, 2017 `140.55 Million- November 11, 2019 `714.29 Million- November 13, 2019 `2,027.03 Million- December 10, 2019

disclosure template for main features of regulatory capital instruments

equity shares

131