Page 225 - Demo

P. 225

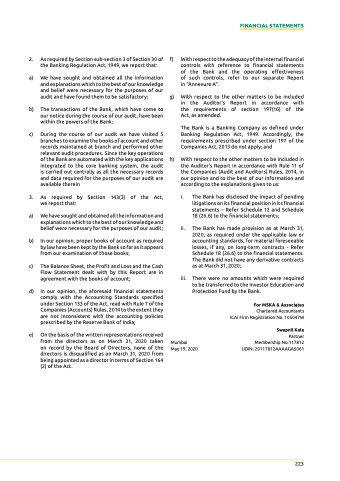

Mumbai

May 19, 2020

For MSKA & Associates

Chartered Accountants ICAI Firm Registration no. 105047W

Swapnil Kale

partner Membership no.117812 uDIn: 20117812AAAAGA5061

FINANCIAL STATEMENTS

2. As required by Section sub-section 3 of Section 30 of the Banking Regulation Act, 1949, we report that:

a) We have sought and obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit and have found them to be satisfactory;

b) the transactions of the Bank, which have come to our notice during the course of our audit, have been within the powers of the Bank;

c) During the course of our audit we have visited 5 branches to examine the books of account and other records maintained at branch and performed other relevant audit procedures. Since the key operations of the Bank are automated with the key applications integrated to the core banking system, the audit is carried out centrally as all the necessary records and data required for the purposes of our audit are available therein

3. As required by Section 143(3) of the Act, we report that:

a) We have sought and obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit;

b) In our opinion, proper books of account as required by law have been kept by the Bank so far as it appears from our examination of those books;

c) the Balance Sheet, the profit and loss and the Cash Flow Statement dealt with by this Report are in agreement with the books of account;

d) In our opinion, the aforesaid financial statements comply with the Accounting Standards specified under Section 133 of the Act, read with Rule 7 of the Companies (Accounts) Rules, 2014 to the extent they are not inconsistent with the accounting policies prescribed by the Reserve Bank of India;

e) on the basis of the written representations received from the directors as on March 31, 2020 taken on record by the Board of Directors, none of the directors is disqualified as on March 31, 2020 from being appointed as a director in terms of Section 164 (2) of the Act.

f) With respect to the adequacy of the internal financial controls with reference to financial statements of the Bank and the operating effectiveness of such controls, refer to our separate Report in “Annexure A”.

g) With respect to the other matters to be included in the Auditor’s Report in accordance with the requirements of section 197(16) of the Act, as amended.

the Bank is a Banking Company as defined under Banking Regulation Act, 1949. Accordingly, the requirements prescribed under section 197 of the Companies Act, 2013 do not apply; and

h) With respect to the other matters to be included in the Auditor’s Report in accordance with Rule 11 of the Companies (Audit and Auditors) Rules, 2014, in our opinion and to the best of our information and according to the explanations given to us:

i. the Bank has disclosed the impact of pending litigations on its financial position in its financial statements – Refer Schedule 12 and Schedule 18 (26.6) to the financial statements;

ii. the Bank has made provision as at March 31, 2020, as required under the applicable law or accounting standards, for material foreseeable losses, if any, on long-term contracts - Refer Schedule 18 (26.6) to the financial statements. the Bank did not have any derivative contracts as at March 31, 2020;

iii. there were no amounts which were required to be transferred to the Investor education and protection Fund by the Bank.

223