Page 248 - Demo

P. 248

Notes to financial statements

for the year ended March 31, 2020

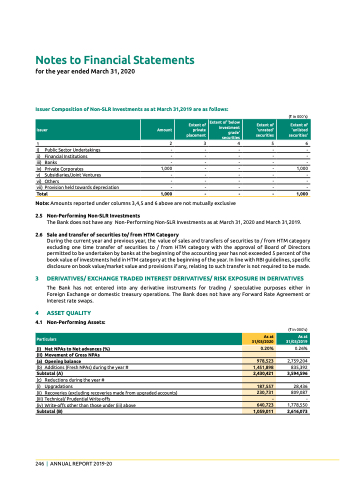

Issuer Composition of Non-sLR Investments as at March 31,2019 are as follows:

1 23456

(` in 000's)

Issuer

Amount

Extent of private placement

Extent of 'below investment grade' securities

Extent of 'unrated' securities

Extent of 'unlisted securities'

i) public Sector undertakings -

ii) Financial Institutions -

iii) Banks -

iv) private Corporates 1,000

v) Subsidiaries/Joint Ventures -

vi) others -

vii) provision held towards depreciation -

Total 1,000

- -

- -

- -

- -

- -

- -

- -

- -

- -

- -

- -

- 1,000

- -

- -

- -

- 1,000

note: Amounts reported under columns 3,4,5 and 6 above are not mutually exclusive 2.5 Non-Performing Non-sLR Investments

the Bank does not have any non-performing non-SlR Investments as at March 31, 2020 and March 31,2019.

2.6 sale and transfer of securities to/ from hTM Category

During the current year and previous year, the value of sales and transfers of securities to / from HtM category excluding one time transfer of securities to / from HtM category with the approval of Board of Directors permitted to be undertaken by banks at the beginning of the accounting year has not exceeded 5 percent of the book value of investments held in HtM category at the beginning of the year. In line with RBI guidelines, specific disclosure on book value/market value and provisions if any, relating to such transfer is not required to be made.

3 deRIVATIVes/ eXChANge TRAded INTeResT deRIVATIVes/ RIsK eXPOsuRe IN deRIVATIVes

the Bank has not entered into any derivative instruments for trading / speculative purposes either in Foreign exchange or domestic treasury operations. the Bank does not have any Forward Rate Agreement or Interest rate swaps.

4 AsseT quALITy

4.1 Non-Performing Assets:

(i) Net NPAs to Net advances (%) (ii) Movement of gross NPAs

(a) Opening balance

(b) Additions (Fresh npAs) during the year #

subtotal (A)

(c) Reductions during the year #

(i) upgradations

(ii) Recoveries (excluding recoveries made from upgraded accounts)

(iii) technical/ prudential Write-offs

(iv) Write-offs other than those under (iii) above

subtotal (b)

(` in 000's)

0.26%

2,759,204 835,392 3,594,596

28,436 809,087 - 1,778,550 2,616,073

Particulars

As at 31/03/2020

As at 31/03/2019

0.20%

978,523

1,451,898

2,430,421

187,557

230,731

-

640,723

1,059,011

246 | AnnuAl RepoRt 2019-20