Page 53 - Sector Alarm Annual Report 2020

P. 53

Sector Alarm / Annual Report 2020

2020

2019

12 836 272 633 -259 797

2019

-262 239

3 467 -5 033 4 909 -901 -259 797

Deferred tax liabilities

1 078 727

0

0

0

0

48 656

1 127 383

0

1 127 383

121 361

283 271

-161 910

Deferred tax asset

Deferred tax liabilities

Net deferred benefit/liability (-) in the balance sheet

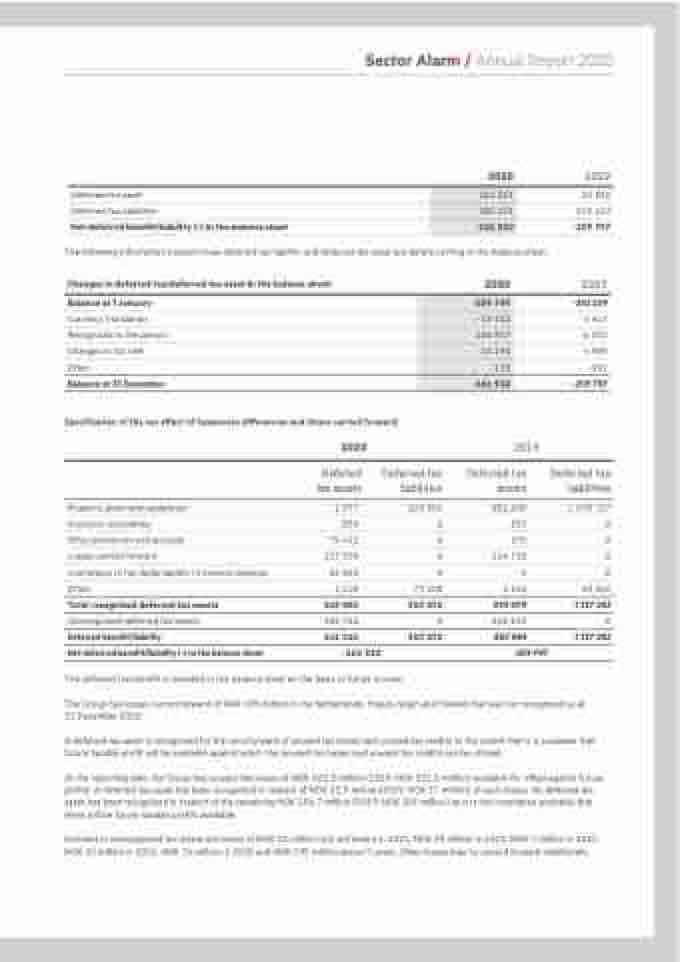

The following information presents how deferred tax liability and deferred tax asset are before netting in the balance sheet:

Changes in deferred tax/deferred tax asset in the balance sheet:

Balance at 1 January

Currency translation

Recognized in the period

Changes in tax rate

Other

Balance at 31 December

Specification of the tax effect of temporary differences and losses carried forward:

2020

-259 797

-19 413

104 837

12 191

272

-161 910

2020

Deferred tax assets

1 077

859

79 431

137 590

25 825

2019

Property, plant and equipment

Accounts receivables

Other provisions and accruals

Losses carried forward

Limitations of tax deductability of interest expense

Deferred tax liabilities

229 963

0

0

0

0

73 108

303 071

0

303 071

Deferred tax assets

852 200

833

676

114 726

0

1 644

970 079

-102 493

867 586

-259 797

Other 1

100

Total recognized deferred tax assets

Unrecognized deferred tax assets

Deferred benefit/liability

Net deferred benefit/liability (-) in the balance sheet

245 883

-104 722

141 161

-161 910

The deferred tax benefit is included in the balance sheet on the basis of future income.

The Group has losses carried forward of NOK 105 million in the Netherlands, France, Spain and Finland that was not recognized as at 31 December 2020.

A deferred tax asset is recognised for the carryforward of unused tax losses and unused tax credits to the extent that it is probable that future taxable profit will be available against which the unused tax losses and unused tax credits can be utilised.

At the reporting date, the Group has unused tax losses of NOK 625,5 million (2019: NOK 521,1 million) available for offset against future profits. A deferred tax asset has been recognised in respect of NOK 32,9 million (2019: NOK 17 million) of such losses. No deferred tax asset has been recognised in respect of the remaining NOK 104,7 million (2019: NOK 101 million) as it is not considered probable that there will be future taxable profits available.

Included in unrecognised tax losses are losses of NOK 11 million that will expire in 2021, NOK 29 million in 2022, NOK 7 million in 2023, NOK 20 million in 2024, NOK 14 million in 2025 and NOK 295 million above 5 years. Other losses may be carried forward indefinitely.