Page 60 - Sector Alarm Annual Report 2020

P. 60

60/61

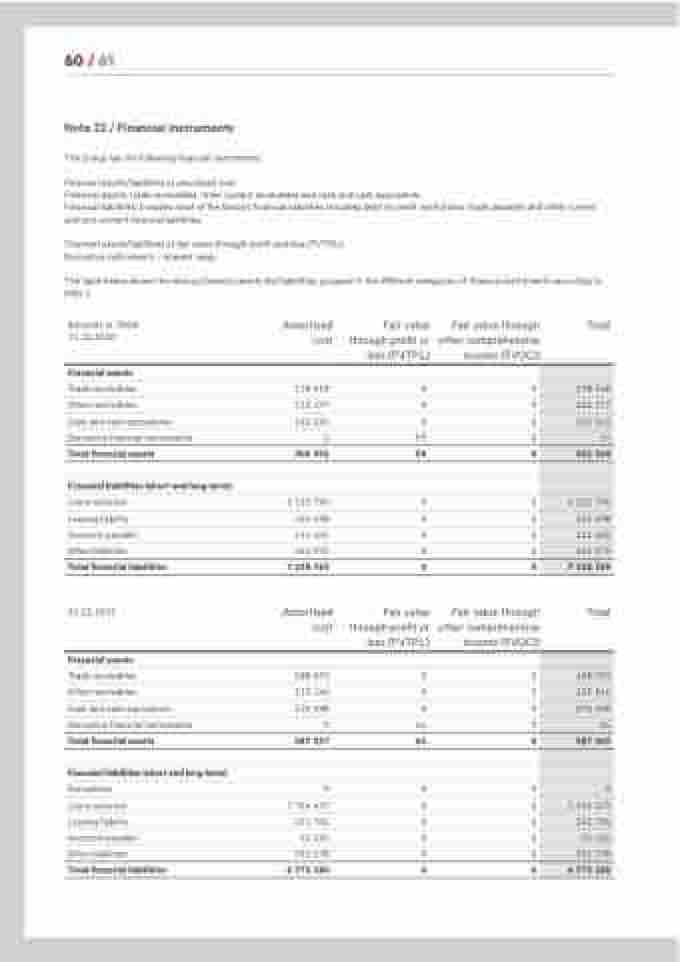

Note 22 / Financial instruments

The Group has the following financial instruments:

Financial assets/liabilities at amortised cost:

Financial assets: trade receivables, other current receivables and cash and cash equivalents.

Financial liabilities: Includes most of the Group’s financial liabilities including debt to credit institutions, trade payables and other current and non-current financial liabilities.

Financial assets/liabilities at fair value through profit and loss (FVTPL):

Derivative instruments – Interest swap

The table below shows the various financial assets and liabilities, grouped in the different categories of financial instruments according to IFRS 9.

Amounts in TNOK 31.12.2020

Financial assets

Trade receivables

Other receivables

Cash and cash equivalents

Derivative financial instruments

Total financial assets

Financial liabilities (short and long term)

Loans external

Leasing liability

Accounts payable

Other liabilities

Total financial liabilities

31.12.2019

Financial assets

Trade receivables

Other receivables

Cash and cash equivalents

Derivative financial instruments

Total financial assets

Financial liabilities (short and long term)

Derivatives Loans external

Leasing liability

Accounts payable Other liabilities

Total financial liabilities

Amortised cost

178 518

112 177

610 256

0

900 951

6 110 796

354 598

111 401

661 975

7 238 769

Amortised cost

Fair value through profit or loss (FVTPL)

0

0

0

59

59

0

0

0

0

0

Fair value through profit or loss (FVTPL)

0

0

0

64

64

0

0

0

0

0

0

Fair value through other comprehensive income (FVOCI)

0

0

0

0

0

0

0

0

0

0

Fair value through other comprehensive income (FVOCI)

0

0

0

0

0

0

0

0

0

0

0

Total

178 518

112 177

610 563

59

901 010

6 110 796

354 598

111 401

661 975

7 238 769

Total

188 093

129 146

270 298

64

587 602

0

5 746 479

341 704

92 426

591 578

6 772 186

188 093

129 146

270 298

0

587 537

0

746 479

341 704

92 426

591 578

6 772 186

5