Page 1 - 2023 Tax Tips from Attorney Greg Braun and BHHS Chicago

P. 1

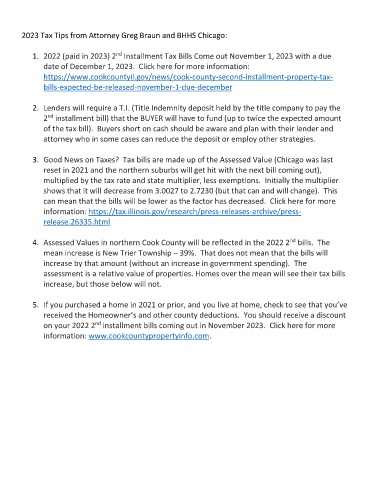

2023 Tax Tips from Attorney Greg Braun and BHHS Chicago:

nd

1. 2022 (paid in 2023) 2 Installment Tax Bills Come out November 1, 2023 with a due

date of December 1, 2023. Click here for more information:

https://www.cookcountyil.gov/news/cook-county-second-installment-property-tax-

bills-expected-be-released-november-1-due-december

2. Lenders will require a T.I. (Title Indemnity deposit held by the title company to pay the

nd

2 installment bill) that the BUYER will have to fund (up to twice the expected amount

of the tax bill). Buyers short on cash should be aware and plan with their lender and

attorney who in some cases can reduce the deposit or employ other strategies.

3. Good News on Taxes? Tax bills are made up of the Assessed Value (Chicago was last

reset in 2021 and the northern suburbs will get hit with the next bill coming out),

multiplied by the tax rate and state multiplier, less exemptions. Initially the multiplier

shows that it will decrease from 3.0027 to 2.7230 (but that can and will change). This

can mean that the bills will be lower as the factor has decreased. Click here for more

information: https://tax.illinois.gov/research/press-releases-archive/press-

release.26335.html

nd

4. Assessed Values in northern Cook County will be reflected in the 2022 2 bills. The

mean increase is New Trier Township – 39%. That does not mean that the bills will

increase by that amount (without an increase in government spending). The

assessment is a relative value of properties. Homes over the mean will see their tax bills

increase, but those below will not.

5. If you purchased a home in 2021 or prior, and you live at home, check to see that you’ve

received the Homeowner’s and other county deductions. You should receive a discount

nd

on your 2022 2 installment bills coming out in November 2023. Click here for more

information: www.cookcountypropertyinfo.com.