Page 4 - Savigny Consulting Limited - Brochure

P. 4

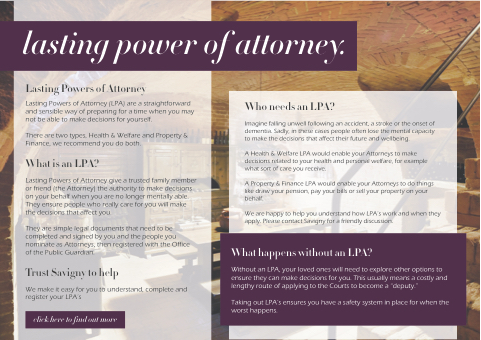

lasting power of attorney.

Lasting Powers of Attorney

Lasting Powers of Attorney (LPA) are a straightforward and sensible way of preparing for a time when you may not be able to make decisions for yourself.

There are two types, Health & Welfare and Property & Finance, we recommend you do both.

What is an LPA?

Lasting Powers of Attorney give a trusted family member or friend (the Attorney) the authority to make decisions on your behalf when you are no longer mentally able. They ensure people who really care for you will make the decisions that affect you.

They are simple legal documents that need to be completed and signed by you and the people you nominate as Attorneys, then registered with the Office of the Public Guardian.

Trust Savigny to help

We make it easy for you to understand, complete and register your LPA’s

click here to find out more

Who needs an LPA?

Imagine falling unwell following an accident, a stroke or the onset of dementia. Sadly, in these cases people often lose the mental capacity to make the decisions that affect their future and wellbeing.

A Health & Welfare LPA would enable your Attorneys to make decisions related to your health and personal welfare, for example what sort of care you receive.

A Property & Finance LPA would enable your Attorneys to do things like draw your pension, pay your bills or sell your property on your behalf.

We are happy to help you understand how LPA’s work and when they apply. Please contact Savigny for a friendly discussion.

What happens without an LPA?

Without an LPA, your loved ones will need to explore other options to ensure they can make decisions for you. This usually means a costly and lengthy route of applying to the Courts to become a “deputy.”

Taking out LPA’s ensures you have a safety system in place for when the worst happens.