Page 22 - BPS PFAR Report Fiscal Year 12.17.2021

P. 22

Property Taxes FY21 Long Term Debt

Balance 06/30/21 Due in One Year

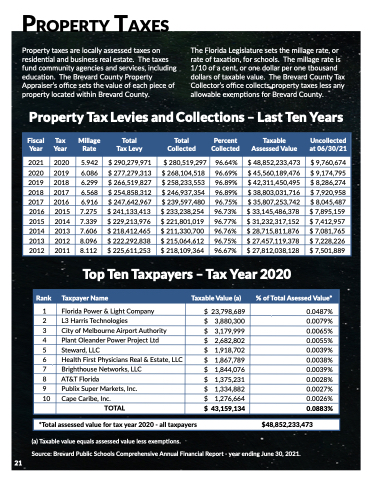

Property taxes are locally assessed taxes on

The Florida Legislature sets the millage rate, or

FY21 Long Term Debt

Balance 06/30/21 Due in One Year

Certificates of Participation

$ 379,661,136 $ 24,373,653

Certificates of Participation

$ 379,661,136 $ 24,373,653

residential and business real estate. The taxes rate of taxation, for schools. The millage rate is

Bonds $ 1,042,430 $ 341,209

Bonds $ 1,042,430 $ 341,209

fund community agencies and services, including 1/10 of a cent, or one dollar per one thousand

Estimated Claims $ 17,684,429 $ 8,436,980

education. The Brevard CountEystiPmroaptedrtCylaims dollars of tax$able val1u7e,.68T4h,e42B9reva$rd Coun8,t4y3T6a,9x80

Compensated Absences $

45,215,955 $ 4,111,216

Appraiser’s office sets the valuCeoomfpeancshatpeidecAebsoefnces Collector’s office collects property taxes less any

$ 45,215,955 $ 4,111,216

property located within BreOvtahredr CPosutnetmyp. loyment Beneafilltoswable$exempti1o6n,9s4f6o,7r 9B3reva$rd County. Other Postemployment Benefits $ 16,946,793 $

-

-

Property Tax Levies and Collections – Last Ten Years

ed Upp

7774Med 1795Gra

2974 1158Spe 6487

179 137 105 196 119

ToptentaxpayersTfortpaxTyeearn202T0axpayers–TaxYear2020 Top ten taxpayers for tax year 2020

Ra

3

Net Pension Liability $ 470,699,579 $

-

-

Net Pension Liability $ 470,699,579 $

TOTAL $ 931,250,322 $ 37,263,058

TOTAL $ 931,250,322 $ 37,263,058 Hig

Hig Qua

21 Me

Fiscal Tax Millage

Total

Total

Percent

Taxable

Uncollected

Fiscal Tax Millage

Total

Total

Percent

Taxable

Uncollect

Year Year Rate

Tax Levy

Collected

Collected

Assessed Value

at 06/30/21

Year Year Rate

Tax Levy

Collected

Collected

Assessed Value

at 06/30/

2021 202

2020

1 202

5.942 0 5.9

$ 290,279,971 42 $ 290,279,9

$ 280,519,297 1 $ 280,519,2

96.64% 97 96.64

$ 48,852,233,473 % $ 48,852,233,4

$ 9,760,674 3 $ 9,760,6

2020

202

2019

0 201

6.086

9 6.0

$ 277,279,313

86 $ 277,279,3

$ 268,104,518

3 $ 268,104,5

96.69%

18 96.69

$ 45,560,189,476

% $ 45,560,189,4

$ 9,174,795

6 $ 9,174,7

2019

201

2018

9 201

6.299

8 6.2

$ 266,519,827

99 $ 266,519,8

$ 258,233,553

7 $ 258,233,5

96.89%

53 96.89

$ 42,311,450,495

% $ 42,311,450,4

$ 8,286,274

5 $ 8,286,2

2018

201

2017

8 201

6.568

7 6.5

$ 254,858,312

68 $ 254,858,3

$ 246,937,354

2 $ 246,937,3

96.89%

54 96.89

$ 38,803,031,716

% $ 38,803,031,7

$ 7,920,958

6 $ 7,920,9

2017

201

2016

7 201

6.916

6 6.9

$ 247,642,967

16 $ 247,642,9

$ 239,597,480

7 $ 239,597,4

96.75%

80 96.75

$ 35,807,253,742

% $ 35,807,253,7

$ 8,045,487

2 $ 8,045,4

2016

20

2015

6 201

7.275

5 7.2

$ 241,133,413

5 $ 241,133,41

$ 233,238,254

3 $ 233,238,25

96.73%

4 96.73

$ 33,145,486,378

% $ 33,145,486,37

$ 7,895,159

8 $ 7,895,15

2015

20

2014

5 201

7.339

4 7.3

$ 229,213,976

9 $ 229,213,97

$ 221,801,019

6 $ 221,801,01

96.77%

9 96.77

$ 31,232,317,152

% $ 31,232,317,15

$ 7,412,957

2 $ 7,412,95

2014

20

2013

4 201

7.606

3 7.6

$ 218,412,465

6 $ 218,412,46

$ 211,330,700

5 $ 211,330,70

96.76%

0 96.76

$ 28,715,811,876

% $ 28,715,811,87

$ 7,081,765

6 $ 7,081,76

2013

20

2012

3 201

8.096

2 8.0

$ 222,292,838

6 $ 222,292,83

$ 215,064,612

8 $ 215,064,61

96.75%

2 96.75

$ 27,457,119,378

% $ 27,457,119,37

$ 7,228,226

8 $ 7,228,22

2012

20

2011

2 201

8.112

1 8.1

$ 225,611,253

2 $ 225,611,25

$ 218,109,364

3 $ 218,109,36

96.67%

4 96.67

$ 27,812,038,128

% $ 27,812,038,12

$ 7,501,889

8 $ 7,501,88

nk Taxpayer Name Taxable Value (a) % of Total Asessed Value*

Rank Taxpayer Name Taxable Value (a) % of Total Asessed Value*

1 1 Fl

orida Power & Light Company

Florida Power & Light Company

$ 23,798,689

$ 23,798,689

0.0487%

0.0487%

22L

Harris Technologies

L3 Harris Technologies

$ 3,880,300

$ 3,880,300

0.0079%

0.0079%

3 3 Ci

ty of Melbourne Airport Authority

City of Melbourne Airport Authority

$ 3,179,999

$ 3,179,999

0.0065%

0.0065%

4 4 Pl

ant Oleander Power Project Ltd

Plant Oleander Power Project Ltd

$ 2,682,802

$ 2,682,802

0.0055%

0.0055%

5 5 St

eward, LLC

Steward, LLC

$ 1,918,702

$ 1,918,702

0.0039%

0.0039%

66H

ealth First Physicians Real & Estate, LLC

Health First Physicians Real & Estate, LLC

$ 1,867,789

$ 1,867,789

0.0038%

0.0038%

7 7 Br

ighthouse Networks, LLC

Brighthouse Networks, LLC

$ 1,844,076

$ 1,844,076

0.0039%

0.0039%

88A

T&T Florida

AT&T Florida

$ 1,375,231

$ 1,375,231

0.0028%

0.0028%

99P

ublix Super Markets, Inc.

Publix Super Markets, Inc.

$ 1,334,882

$ 1,334,882

0.0027%

0.0027%

10 10C

ape Caribe, Inc.

Cape Caribe, Inc.

$ 1,276,664

$ 1,276,664

0.0026%

0.0026%

TOTAL

TOTAL

$ 43,159,134

$ 43,159,134

0.0883%

0.0883%

otal assessed value for tax year 2020 - all taxpayers $48,852,233,473 *Total assessed value for tax year 2020 - all taxpayers $48,852,233,473

21

*T

(a) Taxable value equals assessed value less exemptions.

(a) Taxable value equals assessed value less exemptions.

(a) Taxable value equals assessed value less exemptions.

Source: Brevard Public Schools Comprehensive Annual Report for the year ended June 30, 2020

Source: Brevard Public Schools Comprehensive Annual Report for the year ended June 30, 2020

Source: Brevard Public Schools Comprehensive Annual Financial Report - year ending June 30, 2021.

h h

d

d c