Page 13 - MI New Hire webinar

P. 13

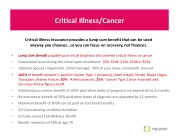

Critical Illness/Cancer

Critical Illness Insurance provides a lump sum benefit that can be used anyway you chooses...so you can focus on recovery, not finances.

• Lump Sum Benefit payable upon initial diagnosis of a covered critical illness or cancer

• Guaranteed issue during this initial open enrollment: $5k, $10k, $15k, $20k or $25k

• Optional Spouse / Dependent Child Coverage: 50% of your lump sum benefit amount

• 100% of benefit amount is paid for Cancer Type 1 (invasive), Heart Attack, Stroke, Major Organ Transplant, Kidney Failure, 30% - Arteriosclerosis, 25% - Cancer Type 2 (non-Invasive) and Coronary Artery Bypass Graft

• Additional occurrence benefit of 100% paid when dates of prognosis are separated by 3-months

• Re-occurrence benefit of 50% paid when dates of diagnosis are separated by 12-months

• Maximum benefit of 300% can be paid on combined benefits

• 3/12 pre-existing condition limitation

• Includes annual $50 Wellness Benefit

• Benefit reduction of 50% at age 70