Page 3 - R&D quick ref guide (legacy 2018)

P. 3

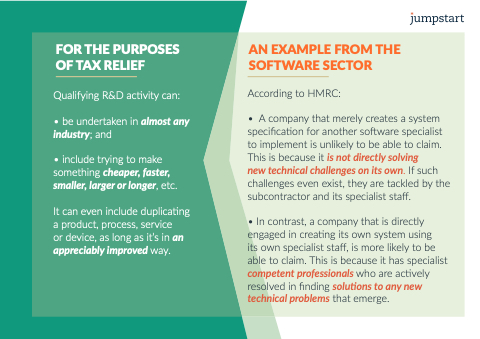

FOR THE PURPOSES OF TAX RELIEF

Qualifying R&D activity can:

• be undertaken in in almost any

industry and • include trying to make something cheaper faster smaller larger or longer etc It can even include duplicating a a a a a product process service

or device as as long as as it’s in an appreciably improved way AN EXAMPLE FROM THE SOFTWARE SECTOR

According to HMRC:

• A company that merely creates a a a a a a a a system specification for another software specialist to to to implement is is is is is unlikely to to to be be able to to to claim This is is is is because it it is is is is not directly solving

new technical challenges challenges on its own If such challenges challenges even exist they are tackled by the the subcontractor and its specialist staff • In contrast a a a a a a company that is directly engaged in tin in creating its its own own system using

its its own own specialist specialist staff is is is is more likely to to be be able to to claim This is is is is is because it it has specialist specialist competent professionals who are actively resolved in fin in finding solutions to any

new technical problems that emerge