Page 11 - Business Owners - Succession Planning

P. 11

- DOWNLOADABLE CONTENT -

Life Insurance as an Attractive Funding Alternative

Did you know you can fund a succession plan with life insurance? A permanent life insurance policy assures there will be funds or resources available when the time comes to complete the succession plan, and it also offers built-in protection for your family.

Having permanent life insurance as part of your succession strategy can give you a significant advantage. Today, 40% of business owners don’t have life insurance, and 50% of businesses are under-insured because they don’t think their business has value, don’t know how to find out, or just don’t have the resources to do so.*

Life insurance can also be a good option because it helps avoid the risks that come with relying on working capital and loans, while providing important benefits.

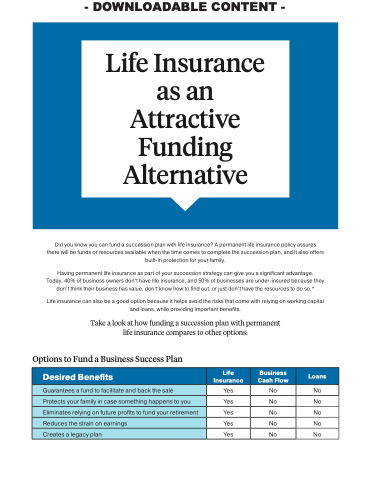

Take a look at how funding a succession plan with permanent life insurance compares to other options:

Options to Fund a Business Success Plan

Desired Benefits

Life Insurance

Business Cash Flow

Loans

Guarantees a fund to facilitate and back the sale

Yes

No

No

Protects your family in case something happens to you

Yes

No

No

Eliminates relying on future profits to fund your retirement

Yes

No

No

Reduces the strain on earnings

Yes

No

No

Creates a legacy plan

Yes

No

No