Page 37 - Kildare CU 2022 AR

P. 37

NOTES TO

THE FINANCIAL STATEMENTS & SCHEDULES

25 c.

25 d. 25 e.

26. 27.

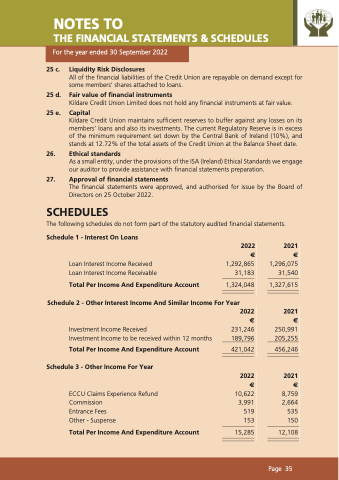

Liquidity Risk Disclosures

All of the financial liabilities of the Credit Union are repayable on demand except for some members’ shares attached to loans.

Fair value of financial instruments

Kildare Credit Union Limited does not hold any financial instruments at fair value.

Capital

Kildare Credit Union maintains sufficient reserves to buffer against any losses on its members’ loans and also its investments. The current Regulatory Reserve is in excess of the minimum requirement set down by the Central Bank of Ireland (10%), and stands at 12.72% of the total assets of the Credit Union at the Balance Sheet date.

Ethical standards

As a small entity, under the provisions of the ISA (Ireland) Ethical Standards we engage our auditor to provide assistance with financial statements preparation.

Approval of financial statements

The financial statements were approved, and authorised for issue by the Board of Directors on 25 October 2022.

SCHEDULES

The following schedules do not form part of the statutory audited financial statements.

Schedule 1 - Interest On Loans

Loan Interest Income Received Loan Interest Income Receivable

Total Per Income And Expenditure Account

Schedule 2 - Other Interest Income And Similar Income For Year

2022 2021

€€

1,292,865 31,183

1,296,075 31,540

1,327,615

2021

1,324,048

Investment Income Received

Investment Income to be received within 12 months

Total Per Income And Expenditure Account Schedule 3 - Other Income For Year

€€

231,246 250,991 189,796 205,255

421,042 456,246

2022 2021

€€

2022

ECCU Claims Experience Refund

Commission 3,991

Entrance Fees Other - Suspense

Total Per Income And Expenditure Account

8,759

2,664 519 535 153 150

15,285 12,108

10,622

For the year ended 30 September 2022

Page 35