Page 6 - ParkView

P. 6

HOW WILL THIS BENEFIT ME?

WE GROW TOGETHER & ELIMINATE RISKS!

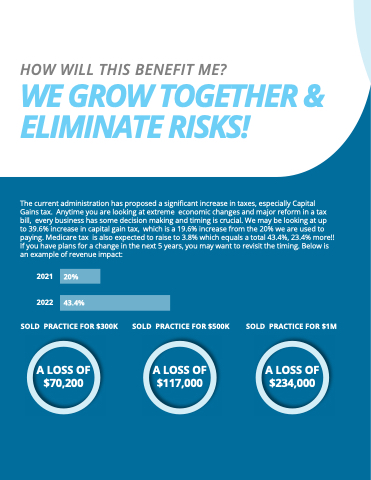

The current administration has proposed a significant increase in taxes, especially Capital Gains tax. Anytime you are looking at extreme economic changes and major reform in a tax bill, every business has some decision making and timing is crucial. We may be looking at up to 39.6% increase in capital gain tax, which is a 19.6% increase from the 20% we are used to paying. Medicare tax is also expected to raise to 3.8% which equals a total 43.4%, 23.4% more!! If you have plans for a change in the next 5 years, you may want to revisit the timing. Below is an example of revenue impact:

2021 20%

2022 43.4%

SOLD PRACTICE FOR $300K SOLD PRACTICE FOR $500K SOLD PRACTICE FOR $1M

A LOSS OF $70,200

A LOSS OF $117,000

A LOSS OF $234,000