Page 167 - Tata Steel One Report 2024-Eng-Ebook HY

P. 167

Business Operation and Performance Driving Business Towards Sustainability Corporate Governance Policy Financial Statements Attachments

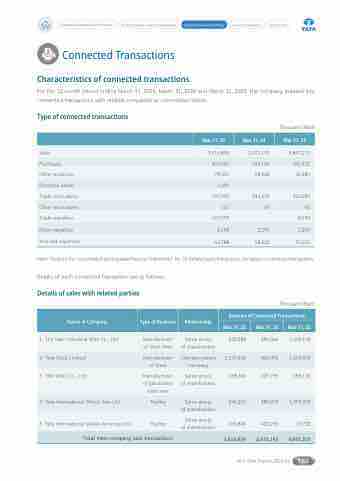

Connected Transactions

Characteristics of connected transactions

For the 12-month period ending March 31, 2025, March 31, 2024 and March 31, 2023, the Company entered into connected transactions with related companies as summarized below:

Type of connected transactions

Thousand Baht

Mar 31, 25

Mar 31, 24

Mar 31, 23

Sales

3,516,854

2,471,192

4,847,215

Purchases

601,526

190,190

391,472

Other expenses

78,331

58,542

36,380

Purchase assets

1,099

-

-

Trade receivables

747,543

244,530

322,080

Other receivables

137

47

45

Trade payables

167,595

-

8,594

Other payables

2,108

2,299

2,203

Accrued expenses

64,788

58,022

35,014

Refer “Notes to the Consolidated and Separate Financial Statements” No. 33: Related party transactions, for details of connected transactions. Details of each connected transaction are as follows:

Details of sales with related parties

Thousand Baht

Name of Company

Type of Business

Relationship

Amount of Connected Transactions

Mar 31, 25

Mar 31, 24

Mar 31, 23

1. The Siam Industrial Wire Co., Ltd.

Manufacturer of Steel Wire

Same group of shareholders

543,588

489,366

1,409,118

2. Tata Steel Limited

Manufacturer of Steel

Ultimate parent company

2,193,446

840,495

1,250,855

3. TSN Wires Co., Ltd.

Manufacturer of galvanized steel wire

Same group of shareholders

158,760

229,799

183,130

4. Tata International Metals Asia Ltd.

Trading

Same group of shareholders

246,215

489,299

1,990,390

5. Tata International Metals Americas Ltd.

Trading

Same group of shareholders

374,845

422,233

13,722

Total inter-company sale transactions

3,516,854

2,471,192

4,847,215

56-1 One Report 2024-25 165