Page 205 - Tata Steel One Report 2024-Eng-Ebook HY

P. 205

Business Operation and Performance Driving Business Towards Sustainability Corporate Governance Policy Financial Statements Attachments

Tata Steel (Thailand) Public Company Limited

Tata Steel (Thailand) Public Company Limited

Notes to the Consolidated and Separate Financial Statements

Notes to the Consolidated and Separate Financial Statements

For the year ended 31 March 2025

For the year ended 31 March 2025

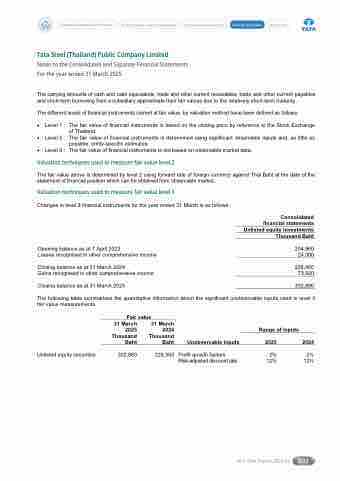

The carrying amounts of cash and cash equivalents, trade and other current receivables, trade and other current payables and short-term borrowing from a subsidiary approximate their fair values due to the relatively short-term maturity.

The different levels of financial instruments carried at fair value, by valuation method have been defined as follows:

Level 3 :

Valuation techniques used to measure fair value llevell2

The fair value above is determined by level 2 using forward rate of foreign currency against Thai Baht at the date of the statement of financial position which can be obtained from observable market.

Level 1 : The fair value of financial instruments is based on the closing price by reference to the Stock Exchange

of Thailand.

Level 2 : The fair value of financial instruments is determined using significant observable inputs and, as little as

possible, entity-specific estimates.

The fair value of financial instruments is not based on observable market data.

Valuation techniques used to measure fair value llevell3

Changes in level 3 financial instruments for the year ended 31 March is as follows:

Opening balance as at 1 April 2023

Losses recognised in other comprehensive income

Closing balance as at 31 March 2024

Gains recognised in other comprehensive income

Closing balance as at 31 March 2025

Consolidated financial statements Unlisted equity investments Thousand Baht

204,960 24,000

228,960 73,920

302,880

The following table summarises the quantitative information about the significant unobservable inputs used in level 3 fair value measurements.

Fair value

Unlisted equity securities

31 March 2025 Thousand Baht

302,880

31 March 2024 Thousand Baht

228,960

Unobservable inputs

Profit growth factors Risk-adjusted discount rate

Range of inputs

2025 2024

2% 2% 12% 12%

56-1 One Report 2024-25 203